What are the 4 PCI Compliance Levels & When Do You Need to Meet Them?

What is PCI-DSS, what are the 4 PCI compliance levels that exist, and when should you meet each one? Continue reading to learn more!

Merchants all over the world have learned quickly that card payments are the most popular way for customers to purchase goods and services. Only 14% of customers would rather pay with cash, while 80% would rather use a card.

Debit, credit, and prepaid cards are all forms of card payment; they are simple, secure, and quick. Companies must maintain PCI compliance levels if they are a retailer or payment service provider (PSP) that manages, processes, stores, or transmits card payment data.

Although you may have heard of this phrase, you might not know what it means, who must comply, why it's crucial, or what will happen if you don't. This post's information will make these issues clear so you can understand what you need to do.

Over the previous year, costs associated with data breaches increased from $3.86 million to $4.24 million, or roughly 10%. As per a 2021 IBM analysis, that was the biggest cost increase in a single year in the previous seven years.

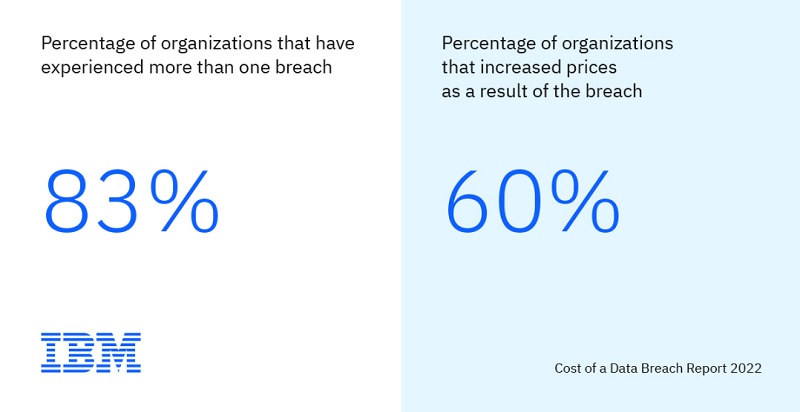

In addition, according to the Cost of a Data Breach Report 2022, approximately 83% of organizations have experienced more than one data breach, and 60% of them increased their prices as a result of the breach.

Cost of a Data Breach Report 2022 by IBM. PCI Compliance Levels.

What is PCI Compliance?

Before we start discussing the PCI Compliance Levels, it is essential to have a good understanding of exactly PCI-DSS is, and what does it mean for you as a business to be compliant.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements that organizations that accept, process, store, or transmit card details must follow in order to keep their systems secure and guard sensitive client data against cyberattacks like breaches, credit card fraud, and identity theft.

The five main card companies—American Express, Discover, MasterCard, JCB, and Visa—created the PCI DSS protocol. These major credit card companies developed regulations that impose on organizations 12 general data security criteria and over 200 specific sub-requirements.

Their main goal was to establish a standard in order to increase controls around cardholder data, as well as to decrease fraud.

Furthermore, the sort of organization will determine the precise compliance needs. However, regardless of the amount or volume of yearly card purchases, the following conditions must be met by all merchants.

What are the PCI Compliance Levels?

According to the quantity of credit card transactions each year, Visa and MasterCard have established the following four levels of PCI compliance:

PCI Compliance Level 1

More than 6 million Visa and/or MasterCard transactions are processed annually.

PCI Compliance Level 2

Annual processing of one million to six million Visa and/or Mastercard transactions.

PCI Compliance Level 3

Visa and/or MasterCard e-commerce transactions range from 20,000 to 1 million per year.

PCI Compliance Level 4

20,000 Visa and/or MasterCard e-commerce transactions are processed annually. Up to 1 million Visa transactions can be completed by all other businesses.

PCI Compliance Levels depend on the number of transactions handled per year

Other factors can also impact the level of compliance within an organization. For example, those who recently suffered a cyberattack or who, in any other way, pose a risk to information security might be given a higher level.

The requirements for organizations to be compliant were further modified with the release of PCI DSS version 4.0 on March 31, 2022. Organizations liable to the PCI DSS should get ready for the update as soon as feasible, even though the present version (3.2.1) is still valid until March 2024.

How do I know if I'm compliant with PCI DSS?

When an organization is PCI DSS certified, they are in compliance. They, therefore, follow the following 12 security guidelines:

• To safeguard credit card information, configure and maintain a firewall.

• Never make use of vendor-provided security configurations, including the system password defaults.

• Safeguard and store cardholder data.

• Securely transfer cardholder data over open, public networks.

• Use and update antivirus software as necessary.

• You can create and manage secure apps and systems.

• Limit cardholder data access according to business requirements-to-know.

• Create a unique ID for each user who has access to the computer.

• Limit physical access to cardholder information.

• Track and monitor all network resources as well as access to cardholder data.

• Test security procedures and systems on a regular basis.

• Keep an information security policy in place for both workers and contractors.

• Along with the 200 minor standards, merchants must also adhere to the 200 major requirements.

These security requirements are designed with the purpose of supporting your organization's development of a strong security system.

Do you need more PCI-DSS info depending on your business? You may want to check these articles:

• PCI-DSS for Merchants: Top 8 Key Steps to Becoming Compliant

• PCI-DSS for E-Commerce: 6 Key Things You Need to Know

• PCI Compliance for HOTELS: What you need to know (PCI-DSS)

• PCI Compliance for Call Centers: 7 Things You Need to Know

What will happen if I don't comply with PCI?

However, failing to attain or enforce consistency in PCI compliance levels can have detrimental effects on a merchant's finances, security, and reputation.

If a business that processes transactions is not compliant, it needs to be prepared for possible data breaches that could put the private information of its customers in danger. The negative effects of these data breaches include customer harm, a decrease in customer confidence, lawsuits, and even corporate closure.

According to a recent study by IBM and the Ponemon Institute, the average cost of a data breach in 2021 will be $4.24 million, 10% more than the $3.86 million it cost on average in 2019. A data leak may certainly ruin small to medium-sized organizations.

Additionally, organizations that break compliance laws may be subject to monthly fines of $5,000 to $100,000 from card brands. The severity of these fines will depend on the number of transactions processed by the company, the percentage of PCI DSS violations, and the specific card company issuing the fine.

How can I achieve PCI Compliance?

Each certification level has a unique certification process. Businesses must complete a self-assessment form for each of the four PCI Compliance Levels. A Report on Compliance is also required for Level 1 and Level 2 merchants (RoC).

Additionally, Level 1 merchants are required to submit to a yearly compliance audit by a Qualified Security Assessor (QSA) (ASV) and a quarterly network scan by an Approved Scanning Vendor. A list of approved QSAs and ASVs is kept up to date by the PCI SSC.

Retailers must regularly evaluate their hardware, software, security, and business operations that control credit card data and transactions to maintain PCI DSS compliance. Merchants must address any system flaws they discover to guarantee the security of card data and transactions.

They must maintain documentation of these evaluations and the steps taken to address any vulnerabilities. They must frequently update the banks and card issuers they work with on PCI DSS compliance.

PCI Compliance Levels: are you PCI-compliant?

1. Determine what you require

To achieve PCI compliance, you must first determine which rules apply to your company. There are four main PCI compliance levels, which are usually determined by how many transactions using credit cards your company handles in a calendar year.

2. Map Data Flow

Before you can protect sensitive credit card information, you must first understand where and how it resides and travels. Make a detailed map of all the programs, networks, and systems in your organization that interact with credit card information. Depending on your position, you may need to work with your IT and security teams to accomplish this.

First, list every part of the company that interacts with customers and accepts payments. You could, for instance, accept payments from customers who place orders over the phone, use payment terminals in-store, or use an online shopping cart.

Next, list all the many ways the company handles cardholder data. Knowing exactly where the data is kept and who has access to it is crucial.

After that, determine which internal systems or underlying technologies are involved in payment transactions. Your network infrastructure, data centers, and cloud environments are all included in this.

3. Evaluate security measures and protocols

After identifying all potential points of contact with credit card information within your organization, collaborate with IT and security teams to implement the necessary security configurations and policies (see the list of 12 PCI DSS security requirements above). These protocols, such as Transport Layer Security (TLS), are intended to safeguard the delivery of data (TLS).

Best practices for safeguarding sensitive data for any firm have been used to develop the 12 security standards for PCI DSS v3.2.1. Many of them overlap with those needed to satisfy HIPAA, GDPR, and other privacy laws, so some of them may already be in place in your company.

4. Keep a track and maintain

It's crucial to remember that PCI compliance levels are a continuous process. Maintaining compliance as data flows and client touchpoints change is a never-ending process. Some credit card companies may require you to submit quarterly or annual reports or to complete an annual on-site audit to ensure ongoing compliance.

To manage PCI compliance throughout the year (and year over year), cross-departmental cooperation and support are frequently required. If one does not already exist, it may be beneficial to form an internal team that is solely responsible for effectively maintaining compliance.

There are several reasons why it's crucial for organizations managing cardholder data to adhere to PCI compliance levels. For example, this set of rules helps to keep cardholder information safe in the event of a data breach. The three pieces of cardholder data—service code, expiration date, and cardholder name—all contain critical customer information that hackers are attempting to obtain.

Merchants' operations will look more reliable and professional if they put client payment information security and protection first. A secure checkout procedure will also boost overall client satisfaction, resulting in repeat business and increased sales.

PCI Compliance Levels

5. Select a PCI-compliant Payment Gateway

The easiest and the most cost-effective way to comply with the Payment Card Industry Data Security Standard is to work with an already PCI-compliant Payment Gateway such as MYMOID.

This is important not only because it will help you achieve the PCI compliance levels that you are looking for depending on your transactions' volume, but also because advanced Payment Gateways like MYMOID allow you to accept online payments in multiple countries, currencies, and use a lot of functionalities that can help you grow your business.

In addition, MYMOID adds additional security features such as PSD2-compliance to ensure that you are fully protected from cyberattacks and cyber fraud as a merchant. Are you ready to get started with PCI-DSS and achieve PCI compliance levels? Contact us today!

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

PCI Compliance for Call Centers: 7 Things You Need to Know

What are some of the most important things to keep in mind when it comes to PCI compliance for call centers?

2018-02-22

6 Types of Payment Methods & Their Pros and Cons

Know about the different types of payment methods that customers can choose from in 2022, and why merchants should aim to offer as many as possible.

2022-07-02

10 formas de reducir los chargebacks de tu negocio

Habilitar los pagos digitales en tu tienda

2018-03-08

¿Listo para empezar?

Pioneros en pagos digitales desde 2012. Con la confianza de más de 5.000 empresas, startups y tiendas minoristas.

© 2025 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy