4 tips to REDUCE Declined Transactions (and improve efficiency)

Useful practices that merchants can undertake to work on improving unnecessary card declines, reduce fraud suspicion, and keep their data safe while re-capturing revenue from declined transactions.

Declined transactions cost companies a significant amount of money: every year, more than $145 billion dollars worth of online purchases are declined for different reasons, mainly because of fraud suspicion. However, various studies have shown that for every 13 transactions declined due to suspected fraud, only 1 one of them was actually fraud.

Today, we will share with you some useful practices that merchants can undertake to work on improving unnecessary card declines, reduce fraud suspicion, and keep their data safe while re-capturing revenue from declined transactions.

Capturing the CVV number can reduce declined transactions

The CVV number, also known as CVV2, is an anti-fraud security measure designed to help merchants and issuing banks verify that you are in the possession of your credit card. The three-digital number is usually found on the back of the card, immediately after the account number, although for some cards (like American Express) it can be found on the front.

Because the CVV number is not required by card brands, some merchants opt to not capture it during checkout, afraid that it will affect conversion negatively as it requires one more data field in the checkout form. However, studies have found that the more data the merchant sends to the issuer on a transaction, the less risky is the merchant as perceived by banks - which will result in higher probabilities that transactions will be authorized. In fact, capturing CVV numbers results in 5-6% increase in approved purchases, and less declined transactions overall.

Enable 3D Secure for international transactions

If a credit card has been rarely used for purchases outside of a specific geographic region and then it's used somewhere else for the first time, it can often be an indicator for a stolen card. However, there is also a high possibility that the cardholder is simply on a holiday or a business trip.

Enabling 3D Secure for both national and international transactions not only increases the possibilities for higher authorization rates by banks, but it also provides additional protection by card issuers to towards the prevention of chargebacks. When 3D is enabled, liability for fraud and chargebacks shifts from the merchant to the issuer.

However, 3D Secure not always guarantees that there will be no card declines or chargebacks. Having a better control over your payment logic and knowing your customers well remain the most successful methods to avoid fraud or bad practices, and a good payment gateway is usually the best way to do that.

Contact the customer directly when soft declines happen

Card declines are usually categorized by two types: soft and hard. Soft transactions are those that may be successful with a subsequent attempt - it means that the card number is valid, but the transaction was denied by the issuing bank due to reasons such as insufficient funds, card expiration, exceeding of the set transaction limits, or unusual purchases.

In these cases, the issue can be easily solved by contacting the customer directly over the phone or by email to ask for verification. If the problem was insufficient funds, or the transaction limit has been exceeded, you can politely request another form of payment from the client. You can also confirm his location over the phone or double-check unusual purchases to prevent fraudulent actions and reduce declined transactions.

When hard declines happen, such as “card stolen”, “invalid card”, or “account closed”, do not try to recapture lost revenue as the issue is probably not temporary, and won't be solved with subsequent attempts.

In these cases, a policy of subsequent attempts will be considered abusive by the processor. After all, the merchant will be using the network without any possibility of the transactions being approved (the card has been blocked due to suspicion or confirmed fraud). In this situation, no retry will end in approval, and will only cause penalties from the network as a result of a high denial rate.

Use gateways that allow you to build your own payment logic

Although there are various tools and practices that may help you reduce the number of denied transactions, it is important to remember that achieving a high approval rate is a long-term process, and each merchant should work on it continuously and strategically.

For this reason, identifying the reason for rejection behind each declined transaction will be key for the development of a sustainable strategy for your business.

Therefore, it is extremely important to process your transactions with a powerful payment gateway that provides you with all the necessary information concerning the transaction. Being able to identify whether the rejection was a result of soft or hard declines will help you discover certain patterns, and work towards their correction in the long run.

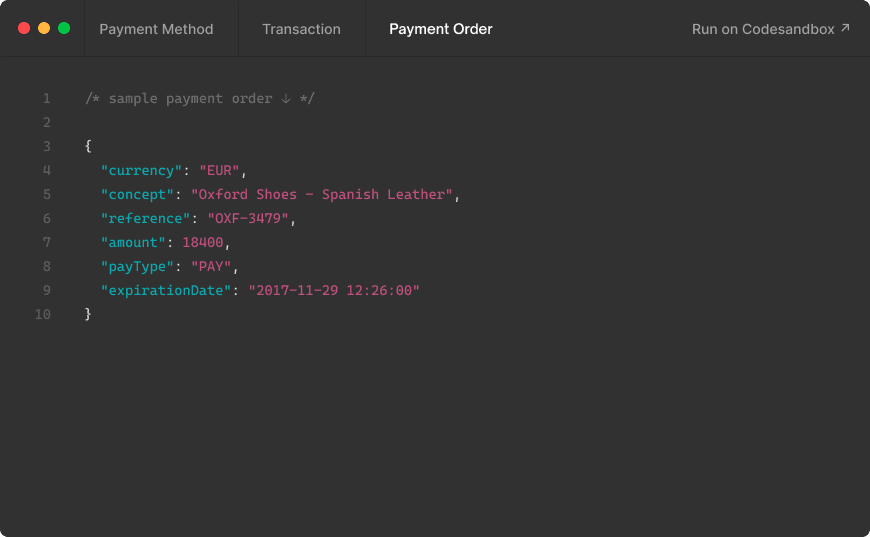

Moreover, a Payment Gateway that is certified in PCI-DSS will not only allow you to store payment data in a secure way and identify easily the customer's buying patterns, but will also allow you to build your own payment logic so you can always have a control over the status of your transactions.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

7 Reasons Why You Need a PCI Compliant IVR Solution for Your Call Center

What is a PCI Compliant IVR Solution, and why is it so important for your call center? Continue reading to learn more!

2022-10-14

Top 11 Ways to Ensure Online Payment Security as a Merchant

The global pandemic

2022-03-02

6 Easy Steps to Write a Payment Reminder for Overdue Payments

Did you know that according to statistics, businesses spend an average of 15 days every year chasing late invoice payments? Continue reading to learn more about how to write a payment reminder that actually works.

2022-06-04

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy