Top 10 Reasons for Declined Credit Cards & How to Handle Them

A high volume of declined transactions on credit cards can lead to a series of negative consequences for merchants.

A high volume of declined transactions on credit cards can lead to a series of negative consequences for merchants, including possible penalties from acquirers and card issuers if the denial ratio is exceedingly high.

However, finding the most optimum solution to handle this common problem will depend on the type of declined transactions that a merchant experiences. In this article, we will discuss the most frequent reasons for declined credit cards, and what businesses can do in order to address them effectively.

But before that, let’s clear out some key concepts:

What does a credit card decline mean?

A credit card decline happens when a customer makes a transaction and an issue occurs that’s preventing it from processing effectively, resulting in a failed purchase. Some common reasons for declined credit cards include insufficient funds, transaction errors, stolen cards and unusual activity, among others.

Declined or failed payment transactions are a common occurrence for many businesses, and this can bring a series of negative consequences for their revenue.

According to VISA and Mastercard, an average of 15% of all recurring payments are declined, a percentage that can get even higher for certain industries.

What do declined credit cards mean for businesses?

Undoubtedly, declined credit cards can be a hassle for customers, but they also have a huge impact on companies.

Revenue loss

Declined credit cards usually translate to failed payments, which cost businesses a lot of money. According to different studies, in the majority of cases when a credit card is declined, only 25% of the customers try out an alternative payment method, whereas 39% directly abandon the sale.

Penalties by acquiring banks

Revenue loss is not the only negative impact that declined transactions have on businesses. In fact, having a high denial ratio can lead to penalties applied by the acquiring bank in response to the request of credit card brands.

This ratio depends on various factors such as the composition of a merchant’s user base and the industry in which he operates.

Fines by payment processors

It is important to consider that while 40% of credit card declines happen due to insufficient funds, up to one third are attributed to merchants’ pitfalls in handling payments.

In addition to penalty fees applied per denied transaction, payment processors may impose even bigger fines if the merchant has a high credit card denial ratio. While it may vary between industries, a good standard to aim for is 75% approval / 25% decline ratio.

Having a higher decline ratio can get you penalized after the third consecutive month of non-compliance with the standard ratios. According to the PCI-DSS guide, the merchant will remain in the non-compliance phase until he has accumulated at least 3 consecutive months of compliance.

How can you calculate the declined transaction rate?

Decline rate can be calculated with a simple formula: the number of declined transactions divided by the number of processed transactions + declined transactions.

Top 7 reasons for declined credit cards

As we previously mentioned, there are a lot of reasons that can cause declined credit cards. Here are some of the most common ones:

1. Insufficient funds

According to Ethoca, more than 44% of all denied transactions happen because the payment method selected by the customer didn't have sufficient funds (in case of debit cards).

If the customer has tried making the payment with a credit card, it simply means that he has hit the credit limit, and his issuing bank won't allow the purchase to go through.

As a merchant, there is very little that you can do if the customer does not have sufficient funds in his bank account. To reduce this cause for declined credit cards, you can offer additional methods for the purchase.

Additionally, you can make them easily accessible at checkout to prevent him from abandoning the shopping cart.

Another way in which you can tackle this issue is to provide flexible payment options, such as the possibility to accept credit card instalment payments. This option allows customers to pay for their purchases over time, dividing the bigger sum into smaller and more affordable amounts.

2. Transactional error

The second most common reason for declined credit cards (20.6%) is that the customer mistakenly entered erroneous data for his card number, expiry date and CVV while entering his payment details.

As a merchant, you can reduce the number of declines due to transaction error by tokenizing the credit and debit cards of customers who have previously purchased a good or a service with you.

In data security, tokenization refers to the process of substituting sensitive data with a non-sensitive equivalent (usually a random string of characters) also known as “token” that has no extrinsic value.

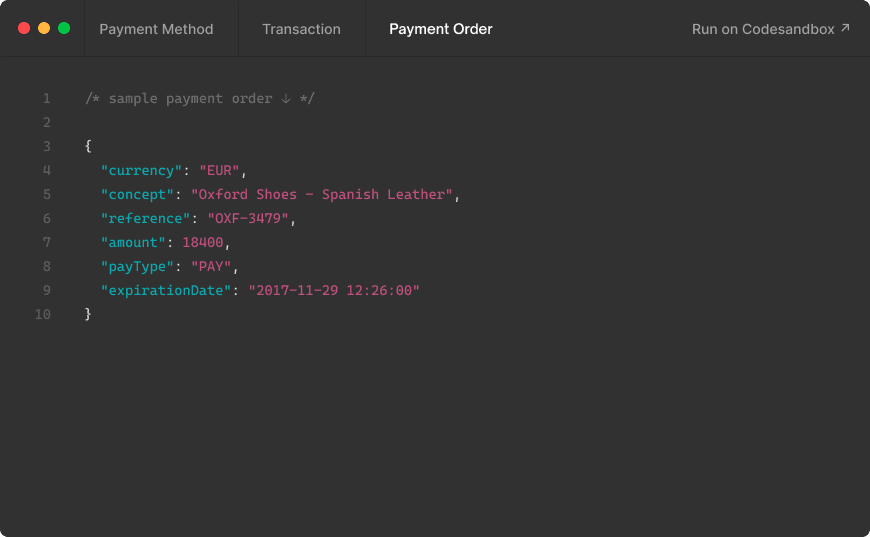

By using a PCI-Compliant Payment Gateway, you can safely store and recover their data for future payments or the consumption of subscription-based services without the process of manual introduction of data.

This way, you can reduce the number in which declined credit cards came as a result of a transactional error.

3. Lost or stolen credit card

According to a research conducted by Ethoca, about 10% of declined credit cards were a result of the card being reported as lost or stolen by its rightful owner. Once the card has been reported as stolen, the issuing bank takes the necessary steps to cancel it and send the owner a new one. Any transaction done with the cancelled card will be declined.

In this case, if the transaction has been declined, it is recommended to not retry it. Merchants can report the transaction attempt to the corresponding issuing bank. For scheduled transactions, it is possible that the card could have been lost before the transaction went through; in this case, get in touch with the cardholder and ask for a different form of payment.

4. Unusual activity

Another common reason for declined credit cards is that the card issuer observed an unusual activity on the credit card. But what does an unusual activity mean exactly? Here are some of the most common cases:

Shopping in suspicious neighborhoods

According to Forbes, if your credit card company notices a shopping spree in neighborhoods that are more prone to suffering fraudulent activities, they may freeze your card - especially if there are purchases in unusually large amounts.

Sudden change in shopping habits

Another activity that can trigger credit card companies and may result in declined credit cards is a sudden change in the shopping habits of the cardholder. For example, spending an amount of money that’s out of the ordinary may raise a red flag and get the card frozen until further confirmation.

In some cases, even making small purchases will be enough to trigger a decline if the transaction looks like testing. Usually, before the thief starts spending frivolously with the stolen credit card, they will test it out to see if it works by purchasing an item for a small amount, or just filling up the car at the gas station.

If a customer typically buys gas in the same area of your location but you suddenly fill your tank up in another part of the city, an alert can be triggered as well.

The shipping address is in a high-risk country

Another sign of unusual activity that can cause declined credit cards is the shipping address of the purchase. Payments from certain countries may require closer scrutiny.

5. Unusual location

Next on our list of common reasons for declined credit cards is making purchases from an unusual location. Depending on your bank and credit card issuer, making payments in another country can raise a red flag if the cardholder didn’t let the bank know that he will be travelling.

It can also happen if the cardholder is suddenly travelling a lot, and is making purchases within multiple countries within a short period of time.

Typically, your credit card issuer is familiar with the geographic boundaries of your regular transactions, and making purchases from another country (even if they are not actually fraudulent) can sometimes alert issuers.

In other cases, if the card issuer observes that purchases are made at great distances from one another in a suspiciously short period of time, this can also be a red flag for fraudulent activity.

6. Change in shipping address

Another common reason that may cause declined credit cards can be as simple as a change in the shipping address of the customer. If the credit card issuer doesn’t recognize the new shipping address and it doesn’t match his usual billing address, the transaction could be declined.

7. An expired credit card

Declined credit cards are often a result of something even more trivial - they have simply reached their expiration date, and the cardholder didn’t realise it before making the purchase.

In this case, you can assist the customers by offering them different payment options so they can still complete the purchase without leaving the shopping cart.

You can achieve that easily with a Payment Gateway such as MYMOID. With our services, you not only have multiple payment options to select from, but you can also expand your business internationally to 45 countries and accept more than 128 currencies.

8. Being behind on payments

Cardholders who are behind on their payments can also face issues when completing their transactions, resulting in a credit card decline. Some credit card issuers can place restrictions on the card if the user hasn’t made a payment recently.

As a merchant, there isn’t much that you can do to resolve this problem. The cardholder would have to make the pending payment, or contact their bank to explain their situation.

9. An exposed security threat

While this might be less common than other causes for declined credit cards, it is something that can still happen. Sometimes, a credit card may have been exposed to a threat, such as a widespread data breach in which many other cards were exposed.

For security reasons, the account may be frozen just to make sure that nobody is using it for fraudulent purposes.

10. Temporary holds

Sometimes, the transaction was declined because the customer hit an “invisible” credit limit on his payment card.

This happens when companies make pre-authorized charges on a purchase, putting a temporary hold on a certain amount of money to ensure that the transaction isn’t fraudulent or that the customer has enough funds in his card.

You can learn more about credit card pre-authorizations by clicking here.

If the customer uses a payment card to rent a car and then uses the same card for checking into a hotel, the sum of both temporary holds might put him over his limit, causing the second transaction to be denied.

Conclusions

There are many reasons why a merchant can experience a high ratio of declined credit cards. In case of a possible fraudulent activity, sometimes it's wiser that you not encourage a retry even if it means a loss of potential revenue for you as a merchant.

In other cases, the problem can be solved by requesting another payment method by the customer, or tokenizing the payment card details through a PCI-Compliant Payment Gateway that allows you to store credit card data safely.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Triangulation Payment Fraud: 5 Key Things You Need to Know

Cybercriminals are constantly finding new ways to get a hold of stolen data and use it to make fraudulent transactions. What does it mean? In this article, we will talk about one specific type of payment fraud that has been growing in popularity:

2022-07-09

5 common misconceptions about mobile payments

Despite the increasing popularity of mobile payments, there are still a lot of myths regarding their convenience that slow overall adoption.

2018-01-11

7 Reasons Why You Need a PCI Compliant IVR Solution for Your Call Center

What is a PCI Compliant IVR Solution, and why is it so important for your call center? Continue reading to learn more!

2022-10-14

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy