10 Effective Ways to Reduce Subscription Churn Rate

What are some of the most effective ways to reduce subscription churn rate? Continue reading to discover how merchants can handle this common challenge.

You built your subscription-based business, established a solid ground for success, and generated a good amount of subscriptions to keep you going. That's great - you've managed to overcome challenges that many business can't. But now, you are facing a new challenge - subscription churn rate.

Why are people leaving after initially being subscribed to your services? Was it lack of customer satisfaction, or a specific event that caused them to leave? How quickly, after being subscribed to your business, did they unsubscribe?

In this article, we will answer these questions, and we will discuss some of the most effective ways to reduce subscription churn rate.

What is subscription churn?

Subscription churn is the number of users that stop paying for a service (or a product) in a given period of time, usually measured on a weekly or a monthly basis. According to Statista, cable companies experience the highest subscription churn rate - 25%, mainly due to their poor customer service and the existence of online streaming alternatives such as Netflix and Amazon Prime.

Customer churn rate in the United States in 2020, by industry. Image: statista.com

Subscription churn rate is a very important metric that all merchants should follow and monitor closely. The reason why it's so important is because it identifies key actions that happen after they've managed to bring the customer on and get them to subscribe.

Unlike other metrics, which tend to measure the progress of the customer journey before they become a customer, churn rates can give merchants extremely insightful information on the growth of their business, helping them identify areas of customer dissatisfaction that can hinder this growth.

This essential metric offers insights into the performance of subscription-based businesses, providing a key assessment of customer retention and revenue.

While a certain churn rate is normal, especially at specific times of the year (depending on the industry), high churn rates are a big red flag and can be detrimental to business growth. There is no use in spending budget on acquiring new customers if you can't retain them.

What is a good subscription churn rate?

Before we take a look at the best ways to reduce subscription churn rate, let's take a look at some numbers that you can use as a benchmark. Exactly what is a good subscription churn rate, and at what point you should be concerned about it?

The average churn rate for subscription-based businesses is 5.60%, according to studies done by Recurly Research. However, this rate will depend on the industry and the business model - B2C companies tend to experience higher churn rates (7.05%) compared to B2B companies (5.00%).

Average churn rates and how to reduce subscription churn rate effectively. Source: recurly.com

Another thing to keep in mind if you want to reduce subscription churn rate is to determine whether it was voluntary or involuntary.

Voluntary churn rate

Voluntary subscription churn rate refers to the cases in which customers are actively cancelling their subscriptions, mainly as a result of customer dissatisfaction. Unfortunately, there isn't a single reason why this happens.

For example, it can happen because their expectations didn't match the reality of the service, they were experiencing a lot of technical issues using it, or they simply didn't find it worth the price they were paying for.

One example could be users unsubscribing from Netflix because they didn't find good movies to watch, so they ended up leaving the streaming service because it didn't match their expectations.

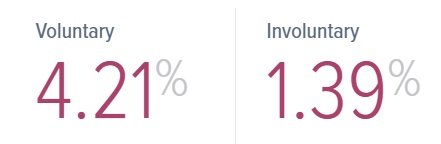

According to Recurly Research, the average voluntary churn rate is 4.21%, compared to just 1.39% for involuntary churn rate.

Involuntary churn rate

As we mentioned, in order to reduce subscription churn rate effectively, it is important to figure out the reason why it happened. Did the customer leave because they weren't happy with the service, or did they experience a payment issue when trying to renew for next month?

Involuntary churn rate refers to the cases in which customers didn't necessarily want to unsubscribe from the service, but they experienced payment issues which made them unable to renew for the next subscription period.

For example, this can happen with recurring payments when the merchant was supposed to charge the customer’s credit card on an agreed date (with the customer's authorization), but their card was expired or didn't have enough funds for the payment to go through.

Needless to say, handling involuntary churn rate is very different than the way you would handle voluntary churn rate. In the next section, we will take a look at some of the most effective ways to reduce subscription churn rate depending on each situation.

10 ways to reduce subscription churn rate

1. Determine the reason of the subscription churn

The most important step to reduce subscription churn rate is to determine the reason why it happened in the first place.

Was it voluntary or involuntary? If it was voluntary, what made the customer cancel their subscription? If it was involuntary, what was the payment issue they experienced, and how can you solve it?

Voluntary churn rates are more complex to figure out because you may not know the real reason of the cancelled subscription until you speak with the customer, which can be challenging as well. Involuntary churn rates can be identified with the help of a powerful Payment Gateway.

2. Collect and analyze information

Once you've determined the percentage of voluntary vs involuntary rates, and which one predominates, the next step to reduce subscription churn rate is to see what kind of information you have at your disposal, and how you can use it to your advantage.

If you don't have any methods set up for collecting information yet, the right time to do it is now:

Collect feedback

Once the customer has clicked on the Unsubscribe button, instead of leaving it there, try to collect feedback on why they are unsubscribing.

It can be as simple as a pop-up that says "We are sorry to see you leaving! Would you mind telling us why so we can do better next time?", and a drop-down of multiple options such as "The product was too expensive", "I wasn't satisfied with your customer support", etc.

How to reduce subscription churn rate - example with the Wordpress plugin Advanced Ads.

Collecting customer feedback is essential for improving your business across multiple areas, and reduce subscription churn rate effectively over the long run.

Look for reviews

Reviews are another golden mine of valuable information on why customers are leaving. Even if you are not able to identify the particular customer that decided to cancel their subscription service (and maybe they didn't leave a review at all), reading through all your reviews will give you hints and powerful insights on the general sentiment.

For example, if you notice that a lot of your subscribers are complaining about technical issues or lack of customer support, these can be logical reasons on why they could be leaving after trying your product for some time.

So, working on improving in these areas can definitely help you reduce subscription churn rate and keep customers as satisfied as they can be.

Monitor activity

Another strategy that you can use to reduce subscription churn rate and grow your business successfully is to monitor what happens on your SaaS platform and website. How are customers behaving and interacting with your services?

For example, if you notice that many people signed up for your CRM service, but they didn't even start using setting it up, this can indicate difficult user experience or a complex interface which is challenging for them to figure out. It could also mean lack of instructions or a guide on how they can start.

You can monitor user activity with a variety of tools, including Google Analytics, session recording tools such as Hotjar and Crazy Egg, heatmaps, or your own Analytics dashboard within the SaaS platform.

3. Figure out payment issues

If you are experiencing high involuntary churn rates, it will be very important for you to figure out the possible payment issues that customers may be facing if you want to reduce subscription churn rate effectively. What prevented them from continuing their subscription even though they wanted to?

Let's take a look at some common cases:

Recurring payments

As we mentioned previously, even though accepting recurring payments is a golden opportunity and the main payment model of subscription-businesses, it doesn't come without challenges.

Graphic by Fit Small Business.

For example, if the customer has been subscribed for a long time to your business with one payment method, after a while the payment method may expire without them realizing it on time, so the payment isn't able to go through when the time comes.

To avoid this, you can send customers an email that their payment method is about to expire, inviting them to change it if they want to continue with the service. You can also place a pop-up on their SaaS dashboard to let them know.

In another occasion, the subscription plan might be on a yearly basis - with such a long time interval, customers tend to forget that they've been subscribed to a particular service.

Before charging them, make sure to send them a reminder that their service is about to renew in order to reduce payment disputes and chargebacks.

Insufficient funds

Insufficient funds are among the most common reasons of credit card declines. For this reason, if you want to reduce subscription churn rate that happens involuntarily due to lack of sufficient funds, you should offer alternative payment methods that they can easily change to in order to continue with the service.

This is especially important for the growth of your business in general, because offering just a limited number of payment methods can prevent you from acquiring more customers. Not offering local currencies ,if you are an international subscription-based service, can also be detrimental for your growth.

For this reason, MYMOID offers payment processing across 45 countries in 128 currencies.

Technical issues

In another situation, the customer had a valid payment method with sufficient funds, but they experienced technical issues when the time for payment came. No matter how good a Payment Gateway is, downtime is bound to happen at one point or another.

When this happens, the customer may not be able to complete their purchase, and the frustration can cause them to not even try again later. For this reason, one thing that you can do to prevent that from happening, and reduce subscription churn rate effectively, is to make use of multiple payment gateways.

4. Use a good Payment Gateway

Using a good Payment Gateway that provides all the necessary tools and features for smooth payment experience is an absolute must if you are looking to reduce subscription churn rate. This is especially important when it comes to involuntary churn rate.

For example, MYMOID offers a variety of features including personalized payment experience at checkout, automated subscription flows so you can manage recurring payments easily, debt collection tools, responsive online payments, and even the possibility for multi-acquiring so you can have a peace of mind at all times.

MYMOID also offers top-level payment security in compliance with PCI-DSS Level 1, PDS2 and more.

5. Provide better customer support

According to Super Office, the biggest reasons why customers leave a company in general is because they think that the company doesn't care about them, followed by dissatisfaction with the service itself.

Providing excellent customer support and enough channels for communication and Marketing is essential if you are looking to reduce subscription churn rate effectively. On one hand, great customer support can help you identify voluntary reasons for churn faster, and solve them before the churn rate increases even further.

In addition, providing enough communication channels and support when the customer wants to reach out to solve an issue is also extremely important for reducing churn rates.

If they were about to leave because of a particular issue with your subscription-based service, but you speak with them and solve it, they may decide to continue with the service. However, if they tried reaching out to you because of an issue they had, and you weren't responsive or fast enough, they can simply decide to unsubscribe.

Conclusion

In conclusion, if you want to reduce subscription churn rate effectively and over the long run, the first step that you will need to take is to identify the reason for churn, and whether the customer actually intended (or not) to cancel their subscription.

Collecting information and knowing how to read it will be extremely important for reducing subscription churn and growing your business successfully. Having a powerful and tool-packed Payment Gateway is a great way to start improving your subscription and revenue metrics - click here to contact us and learn more without any commitment.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

The Spanish FinTech landscape in 2018

Know how the FinTech ecosystem in Spain has grown by 41% in the last 15 months.

2018-03-22

Triangulation Payment Fraud: 5 Key Things You Need to Know

Cybercriminals are constantly finding new ways to get a hold of stolen data and use it to make fraudulent transactions. What does it mean? In this article, we will talk about one specific type of payment fraud that has been growing in popularity:

2022-07-09

5 Benefits of Payment Tokenization for Businesses (2022)

we will talk about tokenization as a smart and effective way to protect cardholders’ data, and we will cover some of the biggest benefits of payment tokenization for both businesses and consumers.

2022-02-02

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy