Acquiring bank: definition and role in payment processing

What exactly is an acquiring bank, and what are its main functions in the process of managing transactions?

The authorization and processing of digital payments require the smooth coordination of various key players within the payment network, and one of the them is the acquiring bank. But what exactly is an acquiring bank, and what are its main functions in the process of managing transactions?

What is an Acquiring bank?

As a digital company, before you start accepting online payments on your website, you will need to sign a contract with a financial institution that will create and maintain your merchant's account. This is important because without this contract, you will not be able to process credit and debit card transactions nor receive payments after their completion.

In other words, an Acquiring bank is the financial institution in charge of processing credit and debit card payments on behalf of the merchant. Every time a cardholder uses his card in a purchase, the Acquiring bank is responsible for authorizing or rejecting the transaction based on the data received from the issuing bank and the card network. If the purchase or payment has been approved, the funds will be deposited into the merchant's account (this usually happens within regular intervals).

How does it all work?

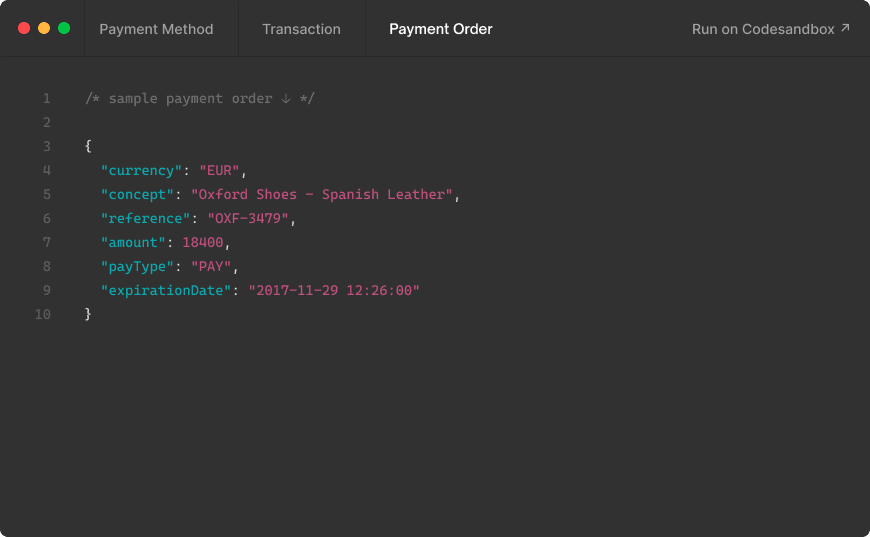

When the customer arrives at checkout to finalize his purchase, the transaction process is first initiated by a payment gateway such as MYMOID which is responsible for acquiring transaction authorization and data encryption to ensure the safe transmission of data along the red.

Once the process has been initiated by the gateway, the acquiring bank takes the transaction data from the merchant and passes it on to the card association (VISA, Mastercard, Discover, American Express, etc).

The card association, along with the issuing bank (the bank of the customer), verify this information and establish the authenticity of the transaction by confirming that the card is valid and has sufficient funds.

Once the transaction has been approved, the card association and the issuing bank send their approval to the Acquiring bank to credit the funds to the merchant. The settlement of the funds between accounts usually happens at a regular frequency.

Risks for Acquiring banks

Acquiring banks are exposed to certain risks when it comes to processing transactions on the merchant's website. In the case of a transaction reversal, a refund or a chargeback, they will be the ones responsible for returning the fund to the issuing bank and the cardholder. This means that they will be out of funds until the amount is recovered from the merchant, and this often comes with its additional costs.

The reversal of funds can be triggered in 3 different ways:

• When the return of funds to the customer is voluntarily initiated by the merchant;

• When the merchant cancels the transaction after it has been authorized (but not yet settled);

• In the case of a chargeback where the validity of the transaction is questioned by the customer.

Chargebacks and out-of-fund situations usually translate to additional costs for the acquiring bank. And last but not least, one of the biggest risks for acquirers is fraud. Because they are the ones responsible for sending the transaction to the issuing bank and the card association, the risk is on them to verify with precision that transactions are genuine.

For this reason, taking the necessary security measures during all steps of the transaction process is crucial for the reduction and prevention of fraud.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

12 datos sobre las brechas digitales que te recordarán cómo debes proteger a tu compañía

¿Qué medidas tomar para reducir las vulnerabilidades antes de que sea demasiado tarde?

2018-02-15

Los pagos online protagonizaron este Black Friday

Conoce acerca de repercusiones de los descuentos masivos sobre el comportamiento de los consumidores.

2017-11-29

5 tech brands showing support for Pride Month

June is Pride Month, a wonderful time to honor the history of queer people, show support, and recognize the oppression that the LGBTQ community still faces around the world.

2018-06-14

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy