8 Effective Ways to Increase Checkout Conversion Rate (2022)

What are some of the most effective ways to increase checkout conversion rate for your ecommerce store?

Generating a sale is the ultimate goal for every merchant. After all, having a constant flow of revenue is what keeps businesses alive and growing.

However, despite the fundamental efforts in creating the perfect product and attracting the right customer for it, there is one crucial part of the customer journey that is often neglected – the payment process.

In this article, we will show you some great ways to increase checkout conversion rate for your ecommerce store. You will also find out how to build an optimized payment experience that will significantly reduce the number of abandoned shopping carts.

In addition, you will see how Gateways are a key component to providing a secure and sustainable payment infrastructure. As a Payment Gateway provider with years of experience, we will share some of our most important observations on the topic.

Why is shopping cart abandonment a problem?

In addition to chargebacks, one of the biggest issues for e-commerce retailers is the high rate of shopping cart abandonment. According to a study conducted by Sleeknote, the average cart abandonment rate is just under 70%, but it can go as high as 81% for some businesses.

This means that approximately 7 out of every 10 online buyers will not complete the transaction, which not only causes a direct negative impact on merchants’ revenue, but also counter-acts on their Marketing efforts.

After all, getting successful with your Marketing strategy only to lose your potential customer right before the purchase is definitely something that no merchant wants.

Source: sleeknote.com. How to increase checkout conversion rate.

Of course, in order to explore the different ways in which ecommerce retailers can increase checkout conversion rate, the first step is to understand some of the biggest reasons why shopping cart abandonment happens in the first place.

They include, but are not limited to:

• Complex or unintuitive checkout process;

• High shipping costs, often unexpected by customers;

• The customer was not ready to purchase;

• Website was too slow or crashed during checkout;

• Not enough payment options were available;

• Lack of card security and other trust indicators;

• Losing customer input when a submission causes an error;

• Non-optimized layout page design;

• Multiple and confusing call-to-action buttons.

According to Statista, the biggest reason for shopping cart abandonment (49%) is that extra costs are too high, which includes unexpected shipping, fees, tax, and other costs that customers weren’t aware of beforehand.

The second most popular reason was an obligatory registration (24%), but other factors such as security and lack of payment methods played an important role as well. In 2021, 17% of US consumers abandoned their order because they didn’t trust the website with their credit card information.

Main reasons why consumers in the United States abandoned their orders during the checkout process in 2021. Source: statista.com.

Considering the multiple reasons that make customers abandon their shopping carts, it is of crucial importance to provide an easy and seamless payment experience to improve their buying journey.

Implementing a functional and optimized payment infrastructure should be a main part of your Business and Marketing strategy. After all, you don’t want to be wasting your money on attracting customers that won’t generate any sales.

And now, let’s take a look at some of the most effective ways to increase checkout conversion rate:

8 ways to increase checkout conversion rate

Although it is not possible to completely eliminate shopping cart abandonment, we have a few tips on how you can increase checkout conversion rate, which will translate to more sales.

Let’s take a look at them:

1. Simplify the checkout process

According to different studies, 11% of your potential buyers will abandon the shopping cart because they found the checkout process to be too complex.

Many websites require a lot of unnecessary information that is completely irrelevant to the purchase – and usually, it works against them.

As an ecommerce retailer, you need to ensure that your visitor’s shopping experience is quick and easy. How can you do that? Here are a few tips:

1.1. Remove extra steps

The first step to increase checkout conversion rate by simplifying the whole process is to remove any extra steps or personal data that is not necessary for the purchase.

Sometimes, companies are compelled to ask for additional information in order to evaluate this data internally and have a better understanding of their target audience, but this can directly impact your conversion rate. Especially if the form is way too long.

According to Baymard, the average number of checkout steps was just 5.2 steps in 2021, and the form should ideally have 8 fields or fewer.

1.2. Experiment with the checkout process

The way the checkout flow is structured also matters if you want to increase checkout conversion rate for your ecommerce.

You can experiment with a single-page or a multiple-page checkout to see which one converts better for your business. Both of them have their [advantages and disadvantages](https://blog.miva.com/one-page-vs-multi-step-checkouts-which-is-better#:~:text=Ecommerce stores that have a,appeal to time-conscious customers.), so there isn’t a definitive conclusion on which one is the best.

1.3. Leave a guest checkout option

As we already saw in the chart above, 24% of users won’t complete their transaction if they are obligated to create an account. For this reason, providing the option for guest checkout is one of the best ways to increase checkout conversion rate.

While getting your customers registered is great for merchants who want to monitor their browser behaviour, and it can certainly be beneficial for customers to store payment data for future purchases, it creates an extra step for them.

So, it’s always better to provide them with options and let them select the one they prefer the best.

1.4. Make your forms easy to fill out

Another way to simplify your checkout process is to make your forms quick and easy to fill. One way to do that is by implementing Google Autofill.

It can save a lot of time and frustration for the customers, improving user experience and making it faster for them to complete the purchase.

2. Offer free shipping and free returns

Free shipping has proven to be one of the most successful marketing tools for ecommerce businesses. Customers would rather pay a little more on a product than spend the same money on shipping.

High shipping costs is one of the major reasons for having a low conversion rate. As we saw in the previous point, a remarkable 49% of all users will abandon the transaction if they perceive the costs associated with it as too high, one of them being the shipping (among other costs that may show up).

For this reason, offering free shipping and free returns (and making it clear to your audience) is one of the best ways to increase checkout conversion rate, and keep customers satisfied.

According to SmallBizTrends, 66% of consumers expect free shipping on every online purchase, and even more people (80%) expect free shipping when they are spending above a certain amount of money in an ecommerce store.

3. Display the visitors' progress during checkout

Another way to increase checkout conversion rate is to display the progress of your visitors during checkout.

Some customers can easily get lost on your website, especially if you are a big ecommerce store with thousands of categories and products available.

To prevent this from happening, it’s always a good idea to have a progress bar that guides users through the checkout process. This way, they will know exactly where they are at each step of their buying journey, and it will make it easier for them to complete the purchase.

To make their shopping experience even better, you can implement a timer that shows approximately how much time is left until the process is complete – especially if you are using a multiple-page checkout. Nowadays, time is a valuable asset that customers will appreciate dearly.

Pro Tip: Avoid displaying website navigation during the checkout process – it distracts the customer's attention from the purchase, and can result in abandonment.

4. Provide clear instructions

Another fundamental way to increase checkout conversion rate is to address any potential issues that might arise regarding the payment process.

For example, you can provide a descriptive text right next to the CVV field with an indication on where to find the code on each card. Error messages should be clearly visible, with clear instructions on the next steps that customers should undertake to resolve them.

Pro Tip: Avoid at all costs having multiple call-to-action buttons at checkout – they confuse and distract the customer from the buying process.

5. Provide local payment experience

Offering a personalized, local payment experience is another great way to increase checkout conversion rate and deliver a great user experience.

Considering today’s globalized economy and the rise of technology, businesses now have the incredible capability of expanding internationally without the need to invest in physical establishments for each country.

Nowadays, generating sales online and being able to send your products to the other corner of the world has never been easier.

However, having a global platform for selling your products doesn’t mean that you should not adapt your payment infrastructure locally.

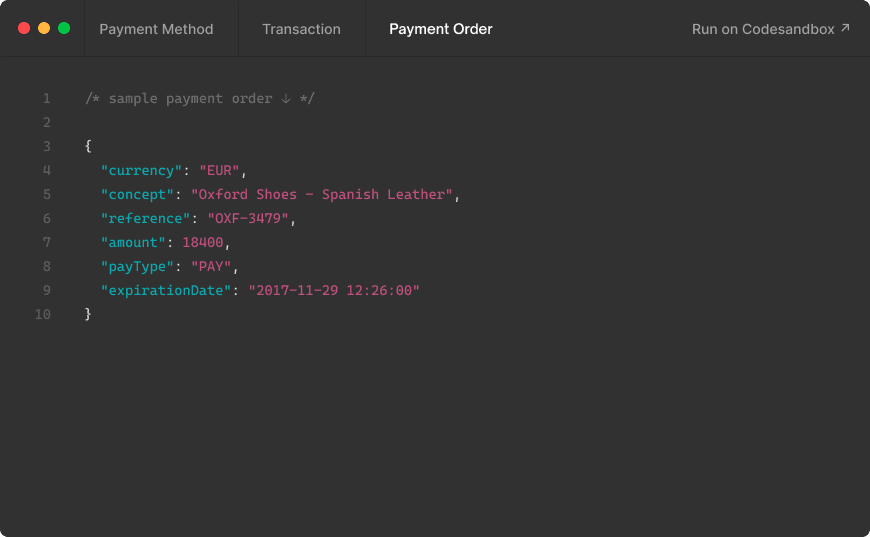

You can achieve that easily by implementing an international Payment Gateway that secures transactions and handles them in multiple currencies with plenty of payment options.

At MYMOID, we are able to process credit card transactions in more than 45 countries and 128 currencies, improving the payment experience of customers – and making it easy for merchants to expand internationally.

6. Enable recurring payments

As we mentioned previously, although not all customers are happy creating an obligatory account in ecommerce stores, having one can be very beneficial for them as it improves user experience in multiple ways, one of which is stored payment data.

Websites that offer recurring payments allow customers to store their credit card details safely, and use them for future purchases without having to fill them out manually every time.

Thanks to a process called payment tokenization, which converts credit card data into undecipherable values called tokens, customers can enjoy a significantly faster and safer payment experience at checkout.

Tokenization is one of the benefits that come with PCI-DSS compliance, and it eliminates the need of re-entering credit card data for each single payment. As a result, returning customers will be able to complete their purchase in the matter of seconds, without having to enter all their data again.

Payment tokenization is highly beneficial for merchants as well:

• It helps to establish trust with their customers by storing transactions safely in a way that makes them less vulnerable to cyberattacks.

• It prevents costly penalties and revenue loss, which are often a result of PCI non-compliance;

• Tokenization also offers improved internal security, because the tokens are unreadable outside the tokenization system.

• It also makes compliance with PCI-DSS (Payment Card Industry Data Security Standard) easier.

And of course, you also have the benefit of being able to offer recurring payments to your customers, which is a feature that many users like to take advantage of.

Additionally, storing payment data for future purchases helps to reduce the number of credit card declines, especially if the error is related to customer input. By storing credit card data safely, you avoid this problem and increase checkout conversion rate for your business.

You can easily offer recurring payment by using a powerful Payment Gateway such as MYMOID.

7. Ensure the correct placement of trust indicators

One of the biggest concerns when it comes to digital payments is undoubtedly cybersecurity. Many customers believe that card-not-present (CNP) payments are not safe – although in reality, they are becoming significantly safer than cash transactions.

Nonetheless, customers are not going to provide their financial details to everyone – and they shouldn’t. They want to know that their data will be protected from cyber attacks, data breaches, and online payment fraud.

For this reason, e-commerce websites must ensure the correct implementation of the necessary security measures; and place their corresponding indicators at checkout.

Some companies comply with the standards for data protection, but do not realise the importance of placing the right indicators during all steps of the buying process.

Of course, if your website is not secure and you are not capable of protecting your customers’ data, it is absolutely forbidden to place security badges without being in compliance.

Instead, you should immediately implement a PCI-compliant Payment Gateway to ensure the full protection of your customers’ credit card information.

8. Provide a failsafe payment process

Ecommerce businesses can also increase checkout conversion rate by providing a failsafe payment process. While issues such as insufficient payment funds can be difficult to solve on the merchant's side, a lot of errors that lead to declined transactions can easily be solved or prevented by taking the right measures. Let's take a look.

8.1. Multiple payment methods

Needless to say, providing multiple payment methods is essential when it comes to high conversion rate and improved customer satisfaction. A lot of declined transactions happen because the selected payment method doesn't have sufficient funds, or because the credit card is expired.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

3D Secure 1 vs 3D Secure 2: What Are The Main Differences?

3D Secure 1 has evolved into a better, faster, and more secure version that protects all parties in an online payment transaction. In this article, we will discuss the main differences between

2022-08-22

Tienda online: Mejora la tasa de conversión con MYMOID

El comercio electrónico está en pleno crecimiento, pero la tasa de conversión sigue siendo un desafío. Una pasarela de pagos optimizada como MYMOID puede ayudarte a marcar la diferencia.

2024-08-19

Triangulation Payment Fraud: 5 Key Things You Need to Know

Cybercriminals are constantly finding new ways to get a hold of stolen data and use it to make fraudulent transactions. What does it mean? In this article, we will talk about one specific type of payment fraud that has been growing in popularity:

2022-07-09

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy