What is Payment Request Link (Pay by Link)? 5 Things You Need to Know

What is Payment Request Link (pay by link), and what are some of the most important things that you need to know before using it?

If you've ever used online payment platforms like PayPal or Venmo, you're probably familiar with the concept of a payment request link, also known as pay by link. Essentially, this is a URL that you can share with others in order to request a payment, and it offers a variety of advantages for both businesses and customers.

While payment request links are a great way to streamline the process of requesting payments from others, there are some things you should know about them before using them. In this article, we'll cover five of the most important things you need to know about payment request links.

What is payment request link?

A payment request link is a unique URL that is generated when you create a request for payment. This link can be shared with the person or organization that you are requesting payment from.

When the person or organization receives the payment request link, they will be taken to a page where they can enter their payment credentials. Once the payment is processed, the funds will be transferred to your account.

You can create a payment request link through most online banking platforms and payment gateways. You will need to provide some basic information, such as the amount you are requesting and your account details. Once the link is curated, you can then share it with the person or organization you are requesting payment from.

Payment request links are a convenient way to request and receive payments online. They are safe and secure, and they can be used for any type of transaction.

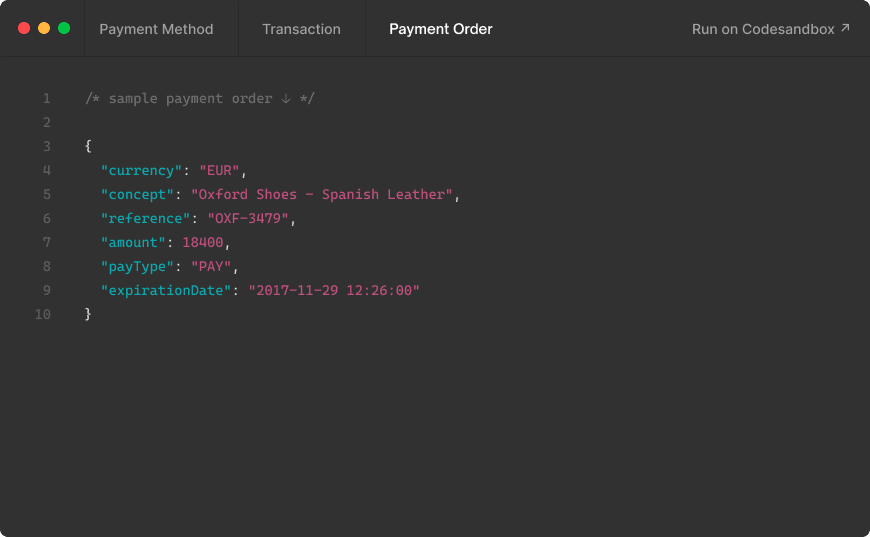

What is payment request link (pay by link)? Image source: zoho.com

1. Creating a payment request link

The process of creating a payment request link will vary depending on your payment gateway, but overall, it's a very simple and straightforward process. In most cases, you will have to:

• Navigate to the payment creation page of your payment gateway

• Open the payment link window and fill in the required information, including the name of the recipient, the currency, and the amount due.

• Add advanced details if you want - for example, if approval of future payments is needed, or if they prefer automatic approval.

• Save your changes and submit the payment request link any way you want - for example, via email, SMS or QR code.

Payment request links are a convenient way to request payment from someone. Especially if you are using PCI-compliant gateway, you can also be completely sure that the information is safe throughout the whole process. A PCI-compliant gateway meets all the official security standards for handling of payment information, including tokenization, encryption, and more.

You can use a payment request link for one-time payments or recurring payments, providing speed, convenience and reliability that your customers will highly appreciate. Whether you are selling products, subscription-based services or accepting payments for small business loans, you can use a payment link to collect funds.

2. Benefits of using a payment request link

As we discussed previously, there are many benefits of using a pay by link, or a payment request link.

A payment request link is a great way to streamline the payment process for your customers. By creating a link that your customers can click on, you can make it easy for them to pay you without having to fill out any forms or provide any payment information.

First, it makes it easy for your customers to pay you. They can click on the link and be taken to a page where they can enter their payment information. Second, it helps to keep your customer's payment information secure.

When they enter their information on your website, it is encrypted and stored securely. Third, using a payment request link can help you to avoid and reduce the amount of chargebacks. When a customer pays you through a link, their bank or credit card company verifies the charge before it is processed. This helps to decrease the risk of fraudulent charges.

Chargebacks can be extremely damaging for businesses - studies have shown that merchants lose $2.40 for each dollar of chargeback fraud, costing the average merchant about 1.47% of their complete revenue.

Overall, a payment request link is a great way to streamline the payment process for your customers. It is easy to use and provides a number of benefits that can help you to avoid chargebacks and keep your customer's payment information secure.

Another benefit of using a payment request link is that the customer can pay via any payment method they want (including their own mobile phone), so there is no need for multiple steps in the checkout process.

3. Drawbacks of using a payment request link

There are a few potential drawbacks to using a payment request link. First, if the person you're sending the link to doesn't have a compatible payment processor, they won't be able to pay you.

Second, there's always the possibility that the payment could get lost or fail to go through for some other reason. And finally, if you're not careful, it's possible to accidentally send a payment request link to the wrong person. So, you will have to be very careful when using it.

And finally, if you're not careful, it's possible to accidentally send a payment request link to the wrong person.

If the customer doesn’t approve your request within 3 days, the payment request link will expire, and then you won’t be able to charge them again until they change their mind and give you permission again.

4. How customers can enhance payment security

Security is extremely important when it comes to pay by link or any other payment method, and companies should take the necessary steps to protect their customers from fraudulent attacks. If you are a customer, here are some things that you can do to further ensure security when paying by link.

First, make sure that the website or service you're using is secure. You can usually tell if a site is secure if it has "HTTPS" at the beginning of the URL. This means that the site is using a secure connection. You should also see a padlock icon next to the URL.

Second, never share your payment information with anyone else. Not even the company or service you're using. If someone asks for your payment information, be very suspicious.

Finally, keep an eye on your account activity. If you see any charges that you don't recognize, contact the company or service right away. By following and adhering to these simple tips, you can help keep your payment information safe when using a payment request link.

5. The importance of having a PCI-compliant Payment Gateway

Of course, while customers an do a few additional steps to ensure that their payment is going to be completed safely, it is the seller who needs to take all the necessary steps to ensure that the payment request link has been secured. For this reason, it's important that all sellers and merchants are using a PCI-compliant Payment Gateway.

PCI-DSS, also known as the Payment Card Industry Data Security Standard, is a set of security protocols designed by the world's biggest credit card issuers, with the purpose of helping businesses secure payment account data.

Under this protocol, which is obligatory for all companies that handle payment transactions, there are set of practices that they need to be compliant with or else they can face serious consequences for non-compliance.

Companies should be compliant with PCI-DSS independently from the payment methods and alternatives that they offer to their customers. This means that merchants who are generating a payment request link should be in full compliance with the protocol, or use a Payment Gateway that is already compliant, such as MYMOID.

Penalties can reach thousands of dollars (or even millions in the case of a data breach). So, if you are creating a payment request link as a merchant, it will be extremely important to be compliant with PCI-DSS, and use security methods such as tokenization and encryption.

6. Solicitations

You may have seen payment request links in your email inbox or on a website and wondered what they are. Payment request links are a fast, easy way to send and receive money. You can use them to pay for goods or services or to collect money from others.

To create a payment request link, all you need is the recipient's email address or phone number. Once you have the recipient's information, you can create the payment request link in just a few clicks.

The payment request link will include all the information the recipient needs to make a payment, including the amount you're requesting and your preferred payment method.

When the recipient presses on the link, they'll be taken to a secure payment source where they can put their payment information and complete the transaction.

It's important to note that payment request links are not meant for sending large payments. The maximum amount you can send using a payment request link is $10,000.

7. Payment options

When you are working with an advanced Payment Gateway, you have a variety of payment options and alternatives to offer to your clients, apart from a payment request link. For this reason, selecting the right gateway is extremely important when it comes to having the flexibility and customization options that you need.

MYMOID is an end-to-end Payment Gateway that allows you to accept payments independently from financial institutions. With MYMOID, you can:

• Expand globally by accepting payments in 128 currencies and 45 countries, without the need to hire local services for each country;

• Transform your data into universal tokens so you can have complete control over your operations;

• Multi-acquisition - we are not tied to any specific processors, which means that you can enjoy multi-acquisition and have even bigger control over your business;

• Connect with us - with our 24/7 customer support, you can enjoy comprehensive communication - we resolve emergency in less than 5 hours;

• Enjoy faster transactions - our automated processes will make your transactions faster, quicker, and more convenient.

• Decrease chargebacks - we provide you with the tools you need to improve your conversion rates and decrease the amount of chargebacks that you are getting.

In addition, MYMOID offers comprehensive, Analytics dashboards that are capable of providing you with extremely valuable insights regarding your operations, conversion rates, country-specific data, and more. You can grow your business by making better decisions based on this data.

And last but not least, having a Payment Gateway that grows with you and helps you expand your business seamlessly is an absolute must. We are fully compliant with PCI-DSS, and we will ensure that all your transactions are safe, sound, and tokenized properly for maximum security.

Are you ready to get started? Contact us today and get a demo of our software with a qualified representative. We will be happy to answer all of your questions.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

PCI Compliance para hoteles: cómo afectan al sector las normas de seguridad para tarjetas de pago?

El estándar PCI-DSS para la gestión de tarjetas de crédito y débito se convirtió en una consideración esencial para todos los hoteles, y MYMOID te explica cómo adaptarlo en tu empresa.

2017-11-14

Banco Emisor, Adquirente y el rol de la Pasarela de pagos

Conoce el rol del banco emisor, el adquirente, el banco del comercio y, por supuesto, la pasarela de pagos, el engranaje que conecta todo.

2024-11-28

Fraude online: medidas de seguridad avanzadas con MYMOID

El fraude en pagos en línea es una amenaza real. Las pasarelas De Pagos ofrecen soluciones para protegerte.

2024-08-13

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy