PCI-DSS for Merchants: Top 8 Key Steps to Becoming Compliant

What are some of the most important steps that need to be taken when it comes to PCI-DSS for merchants? Continue reading to learn more!

As we advance in each era, serious risk factors are getting even worse with technological advancements. Especially with the rise of online payments, companies have become a primary target for cyberattacks, and many of them don't know how to prevent and deal with them adequately.

According to the Global Risk Report by Keeper and Ponemon Institute, 66% of companies have experienced a cyber attack in the past 12 months. And the worse part is - cyber attacks and data breaches may take up to 197 days to be discovered, time that can be absolutely devastating for the company's reputation and financial health.

_Image source: [ebroker.com](https://www.embroker.com/blog/cyber-attack-statistics/#:~:text=Frequency of attacks%3A 66%25 have,attacks are becoming more targeted.)_

Luckily, the same technology that makes companies vulnerable to cyberattacks is also able to come to their rescue. By implementing a set of security practices, accepting online payments can be a lot easier, safer, and reliable - in fact, sometimes even safer than offline payments.

This set of security practices is called PCI-DSS, also known as the Payment Card Industry Data Security Standard. Designed and set by the world's biggest card issuers, this standard is the golden guide for every company that is looking to accept online payments securely and with reduced risk for cyberattacks.

What is PCI-DSS?

As we mentioned previously, PCI-DSS, or the Payment Card Industry Data Security Standard, is an information security standard developed and implemented by the biggest credit card companies as a regulation for safeguarding sensitive payment information that can be a target for cyberattacks.

Put simply, any organization that handles the storage, processing, transmission, or impact of cardholder data security must be PCI compliant. In case of non-compliance, which can have serious consequences, a company risks huge penalties from card issuers or even termination of their commercial activity.

It can be difficult to become PCI compliant since there are varying reporting levels and validation standards for distinct PCI merchants and service providers following how they deal with cardholder data and the number of card transactions they process annually.

In fact, becoming PCI-compliant can [cost up to $70,000](https://www.standardfusion.com/blog/cost-of-pci-dss-compliance/#:~:text=The cost of PCI DSS,pay a minimum of %2470%2C000.) annually for large businesses, which can be a challenging sum for many companies. Luckily, PCI-DSS for merchants and other organizations can also be achieved by hiring an already PCI-compliant Payment Gateway - but more on that later.

Why is PCI-DSS important for digital payment security?

The PCI-DSS standard, which is practically a guideline or a standard rather than legislation, is implemented through agreements between merchants, banks that handle payment card activities, and payment brands. It is important for because it ensures that all participants in an online payment transaction are able to complete the transaction securely, reducing the risk for data breaches.

Essentially, PCI-DSS for merchants don't differ compared to PCI-DSS for other types of organizations, the guidelines are the same and should be followed strictly. However, it's crucial to understand it's importance for merchants, and how it can be properly applied across all areas of their activity.

PCI-DSS for merchants: protection of cardholder payment data

Regarding PCI-DSS compliance infractions, each payment brand has the authority to penalize acquiring banks. In response, acquiring banks have the power to exclude non-compliant businesses from accepting card payments.

PCI-DSS for merchants is compliance that gives a merchant the confidence that they are adhering to the best practices and most recent standards to protect their customers' data.

PCI DSS compliance is a secure way to stick to the standards set by the experts to ensure maximum protection against embezzlement. Moreover, it helps the service providers and merchants to have a theft-free ground to work on.

Any entity that takes, maintains, or receives payment data, such as credit card information, must be PCI compliant, per the PCI Compliance Security Standard Council. It safeguards consumers and prevents their card details from being trusted by a shady company.

So, let's take a look at the steps that you will need to take when it comes to PCI-DSS for merchants:

1. Determine whether you are a merchant or a service provider

Two types of entities engage with cardholder data: merchants and service providers.

A merchant is a company that takes payments from customers immediately for products and services, such as an online or brick-and-mortar shop.

Both merchants and service providers must formally verify their level of compliance with PCI each year using a Self-Assessment Questionnaire (SAQ) or Statement on Compliance (ROC). The entity must finish a valid Attestation of Compliance for the SAQ and ROC examinations (AOC).

The amount of assessment and supporting documentation needed for PCI compliance is the main distinction between the SAQ and ROC. Although a ROC should always be carried out by an external Qualified Security Assessor (QSA) or Internal Security Assessor, an SAQ is often carried out by an Internal Security Assessor (ISA).

The amount of yearly transactions is the main factor determining the level of Certifications and authentication a company is expected to satisfy. Let's take a look at this brief table:

• PCI Level 1: Merchants that process over 6 million transactions per year

• PCI Level 2: Merchants that process 1 million to 6 million transactions per year

• PCI Level 3: Merchants that process 20,000 to 1 million transactions per year

• PCI Level 4: Businesses processing less than 20,000 transactions per year

Depending on the level of risk, a prior intrusion, or other variables, a bank or the card company may demand that a business fulfil a better degree.

2. Adherence to PCI-DSS for merchants

Multiple PCI compliance levels categorize merchants and service providers and specify why they should verify compliance. PCI compliance standards one through four for retailers are generally determined by the volume of completed transactions annually.

A merchant is considered "Level 1" and must submit a Report on Compliance if they execute more than six million payments yearly. Merchants with fewer transactions fall into the Level 2-4 category and are often eligible to answer a Self-Assessment Questionnaire.

Many companies are unaware of their enlisted provider position, which puts their operations and clients in danger. Even if your company primarily serves customers as a merchant, taking into account, all managed service aspects will allow you to holistically examine your compliance with the Payment Card Industry Data Security Standard (PCI DSS).

Many companies are unaware of their enlisted provider position, which puts their operations and clients in danger.

Even if your company primarily serves customers as a merchant, taking into account, all managed service aspects will allow you to examine your compliance with the Payment Card Industry Data Security Standard holistically (PCI DSS).

3. What requirements do you need to fulfil?

PCI-DSS for merchants

You must submit an SAQ to prove that you are following all 12 requirements for the SAQs required by it, and you must have a scan from an ASV every three months.

An SAQ may be used by most businesses with fewer than six million yearly transactions to prove PCI compliance. Depending on how your business deals with user credentials, there are a few SAQs for PCI-DSS for merchants to select from.

The PCI Security Standards Council, the regulatory organization upholding various PCI programs, has provided comprehensive instructions for identifying your SAQ category.

There are three primary categories of SAQs:

SAQ A

Any e-commerce business where a payment card isn't physically present during the transaction falls under SAQ A. All operations involving cardholder data are delegated to a third-party service provider. On the systems or property of the merchant, there is no storage, processing, or transmission of any cardholder data.

A-EP SAQ

SAQ A-EP is also available for e-commerce businesses that contract with PCI DSS-compliant third parties for all processing payments. On the systems or property of the merchant, there is no storage, processing, or transmission of any credit card information.

A-EP organizations do, though, have web pages that may affect the safety of the payment transaction.

SAQ D

Any retailer who doesn't fall under one of the above categories will require an SAQ D. Every service provider is qualified to finish the requirement.

Keep your qualification

The Rock and Amok are both good for a year. You must finish an SAQ or Rock every year to keep your certification. To keep up your PCI certification, you'll need to schedule the following recurring actions throughout the year:

Analyze logs and notifications daily to look for abnormalities or suspicious activities.

Weekly tasks: At least weekly file quality monitoring scans with crucial file comparisons are required. Execute merchant security fixes monthly to ensure that systems and software components are safe from common vulnerabilities.

Monitor user access every three months, look for illegal cellular connections and confirm that information that hasn't been erased has been destroyed.

You must also use an established scanning vendor to execute vulnerability scans (ASV).

4. Protect cardholder data

The main goal of PCI-DSS for merchants is to protect cardholder data. Organizations must safeguard cardholder data if it is kept locally, in the cloud, or sent over online.

Data on cardholders shouldn't be kept unless there is a commercial necessity. Primary account numbers (PANs) must be made illegible if stored.

Only keep cardholder data for as long as is necessary for commercial, legal, or regulatory purposes.

PCI-DSS for merchants: the importance of protecting cardholder data

5. Setup secure access management systems

An authentication protocol must always be set up for parts of the system that limit access based on the ought-to-know concept and that are set to unless expressly authorized.

Additional people having access to the data increases the likelihood that it will be abused. Consequently, only individuals with valid reasons ought to be granted entry.

Before enabling users to access components or cardholder data, give them each a distinct identity. Control user IDs, passwords, and other identifying items' insertion, deletion, and alteration.

Accessibility to user accounts that aren't being used for any purpose should be promptly revoked. Within 90 days, inactive login credentials should be deleted or deactivated.

6. Ensure the safety of all media containing potentially sensitive data

When cardholder data is scrawled on a paper document, left on a table, or retained securely on portable media, it risks the system. Backups of critical material must also be kept in a secure location.

Backups of sensitive data should be kept in a safe location, ideally in a secondary or backup data centre.

At a minimum, once each year, the security of the location where confidential data is kept should be evaluated. The more system components there are, the greater probable it is that significant events won't be detected when exposure to network elements is tracked manually.

It is advised that the admission tracking, control, and rebuilding processes be computerized. Ensure that the configuration requirements adhere to widely-accepted hardening system standards and handle all security holes.

Executing functions on the same server that need various degrees of protection is not recommended. The control structure should be examined to ensure that just one principal function is executing on a single server.

For instance, different computers must be used to set up and run web servers and database servers.

7. Install a Web Application Firewall

When it comes to PCI-DSS for merchants, the next step to take is to install a web application firewall.

It entails a manual evaluation of the source code for web applications and a vulnerability analysis of the application's security. The evaluation must be conducted by a qualified internal resource or outside party, and an external entity must grant an agreement.

To ensure that all potential dangers are adequately countered concerning PCI-DSS for merchants, the assigned reviewer must also remain current on the most recent developments in web application security.

Alternatively, enterprises may protect themselves against assaults at the application layer by deploying a WAF between the application and customers. All incoming traffic is inspected by the WAF, which removes harmful attacks.

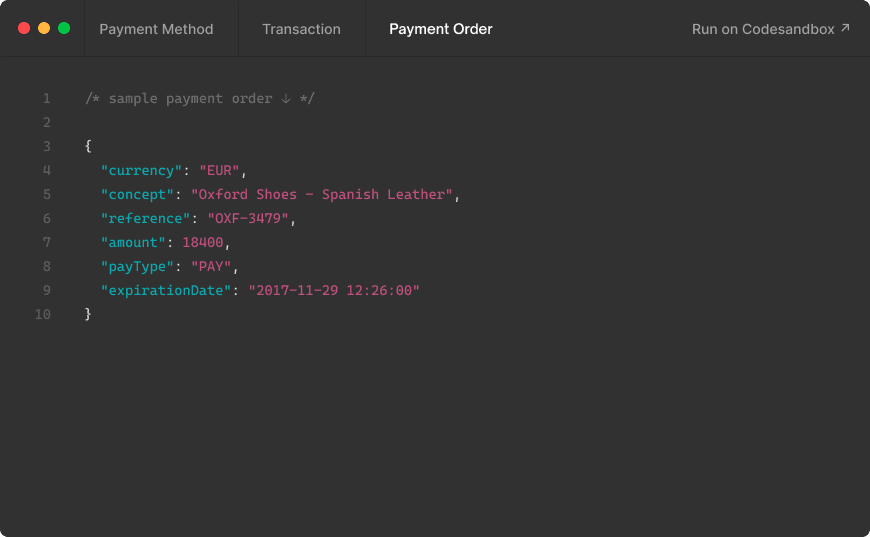

PCI-DSS for merchants: implement a PCI-compliant payment gateway

8. Use a PCI-compliant Payment Gateway

Achieving PCI-DSS for merchants can be a lengthy and extremely costly process. In fact, achieving compliance doesn't mean that you will not have to do anything after that - you will also have to maintain it, which quickly adds up not only to your budget but also to your time and staff needed for the maintenance.

Luckily, you don't have to go through this process alone. By hiring a payment gateway that's already PCI-DSS compliant, you can achieve maximum security for you and your clients without having to spend thousands of dollars. Are you ready to get started? Click here!

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

¿Cómo reducir la tasa de abandono del carrito de compras?

2024-07-03

Guide to Friendly Fraud: 7 Important Things You Need to Know

What is friendly fraud, what are the most important things that you need to know about it, and how can you prevent it as a merchant?

2022-07-09

5 Effective Ways to Win a Chargeback Dispute As a Seller

What are some of the most effective ways to win a chargeback dispute as a seller? Find out more in this article!

2021-01-16

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy