5 Effective Ways to Win a Chargeback Dispute As a Seller

What are some of the most effective ways to win a chargeback dispute as a seller? Find out more in this article!

Created as a way to secure the use of credit cards against fraud, chargebacks are a necessary tool for protecting customers from losing money due to fraudulent or unauthorized transactions.

Unfortunately, they can be really damaging for businesses, costing them more than 1.47% of their total revenue, and putting merchants in risk of getting penalties from card issuers.

Chargeback rates of over 1% can result in costly fines, causing businesses to lose $2.40 for each dollar of chargeback fraud.

Image source. How to win a chargeback dispute as a seller

In other words, chargebacks have a history of affecting merchants negatively, especially considering that 49% of chargebacks are filed unintentionally, and could have been prevented with the right measures.

While there isn’t a guarantee to win a chargeback dispute as a seller even if you are in full rights, there are some steps that you can take to increase your chances significantly.

What is a chargeback?

Before we dive deep into the topic, it is important to ensure that the concept of chargebacks is clear. So, what exactly is a chargeback, and why is it affecting merchants so much?

A chargeback is a form of customer protection that enables customers to file a dispute against the merchant as a result of not recognizing a transaction on their statement.

If the cardholder chooses to file a dispute due to concerns for fraudulent transactions, the issuing bank will investigate the case to determine its legitimacy before making the final conclusion.

As a seller, if a customer decides to file a dispute against you, it will be in your hands to provide enough evidence for proving that the transaction was legitimate.

If the issuing bank is not convinced by your evidence and concludes that the transaction was indeed fraudulent, the amount of the purchase will be taken from your account and given back to the customer (and you will probably have to pay an additional fee of up to $100 or more, depending on the bank).

What are the different types of chargebacks?

The first mechanism for credit card chargebacks appeared around 1968 with the implementation of the Truth in Lending Act.

It was created with the purpose of protecting cardholders from criminals or unscrupulous merchants who took advantage of them to get hold of their money without delivering the promised goods or services.

In other words, it was a mechanism that ensured that the cardholder´s money was safe.

However, despite the initially good intentions, not much time passed before chargebacks evolved into something entirely different: the so-called Friendly Fraud.

In order to fully understand the steps that you will need to take in order to win a chargeback dispute as a seller, let’s take a quick look at the different types of chargebacks that exist:

1. Friendly Fraud chargebacks

Friendly Fraud, as ironic as the name sounds, happens when a customer makes a purchase, consumes the product or service, and then disputes the transaction with the bank as opposed to asking for a refund directly from the merchant.

In such cases, users file an illegitimate chargeback dispute claiming that the item was not delivered, the original transaction was not authorized, or the item did not arrive as described. Despite the fact that they actually consumed the product or service.

It is important to understand that not all customers that file illegitimate disputes have malicious intentions.

Sometimes, the cardholder simply didn’t understand the payment process, the product, or the purchase was made by a family member without letting him know about it.

In other cases, the return policy wasn’t easily accessible or was impossible to understand, frustrating him to such an extent that he chose to file a chargeback instead of dealing directly with the merchant.

2. Criminal fraud chargebacks

One of the most common types of chargebacks are those labelled as criminal fraud. They typically occur when a criminal or a hacker steals a credit card or a credit card number, and uses the payment details to make unauthorized purchases.

It is estimated that between 1% and 10% of all frauds occur as a result of chargeback scams, and they can be really damaging for merchants.

For this reason, it’s important that businesses constantly monitor any suspicious activity to identify possible red flags in consumers’ behaviour.

3. Merchant error chargeback

Of course, it’s important to keep in mind that not all chargebacks are illegitimate or filed with malicious intentions. In many occurrences, customers may start a dispute because of merchant errors, such as:

• Billing descriptions with incorrect information

• Unclear return policies

• Product descriptions with unclear information

• Errors when processing transactions

For this reason, in order to win a chargeback dispute as a seller, merchants must ensure that they are providing clear and transparent information at all times, and that getting in touch with them is easy to avoid customer frustration.

As we just mentioned, many chargebacks can be a cause of customer frustration rather than bad intentions.

How to win a chargeback dispute as a seller

Source: chargebacks911.com

Whether the chargeback dispute was legitimate or not, having a high volume of chargebacks can be really damaging for your business.

In fact, if chargebacks account for over 1% of your total transactions, you could be classified as a high risk business by the payment processors, incurring in high costs, high fees, and other damaging consequences such as being put on a MATCH list (Member Alert To Control High-risk Merchants).

Considering that this mechanism was created for customer protection, winning a chargeback dispute can be a really challenging and exhausting task for businesses.

For this reason, merchants should do everything possible to reduce the risk of getting disputes, such as taking some of the following actions:

• Improve customer service

• Use fraud detection tools

• Get certified in PCI-DSS

• Implement a secure Payment Gateway to ensure that they have full control over their payment logic.

Chargeback disputes will happen, and as a merchant, you will lose some of them; this is completely normal for online businesses.

However, this doesn’t mean that you should not take action – in fact, in 50% of the successfully executed cases of Friendly Fraud, customers will file another illegitimate chargeback within the next 90 days.

Along with the consequences that come with high chargeback volumes, this is just another reason why you should defend your rights as a seller.

To win a chargeback dispute as a seller, here are some of the things that you can do:

3.1. Maintain accurate records and gather compelling evidence

The first thing that you can do to win a chargeback dispute as a seller is to maintain accurate records and gather compelling evidence about the transactions that you have processed on your platform.

Disputes are usually much less favorable for merchants than they are for customers. In this situation, it will be in your hands to provide enough solid evidence to prove that the transaction was legitimate.

For this reason, it is extremely important to maintain accurate and detailed records from the very beginning.

Carefully documented transactions are crucial for winning a chargeback dispute, including:

• Confirmation emails

• Automated invoices

• Follow-up emails

• Emails with relevant tracking details

And other types of documents and communications with the customers are a must for maintaining a compelling record to present during a dispute.

Another evidence to collect are signatures upon product delivery. Make sure that you always ask for signatures. If the seller isn’t able to prove that the item was actually shipped (especially if the customer claims that it wasn’t), he is much less likely to win the dispute.

Other evidence that might be favourable in order to win a chargeback dispute as a seller includes any communication (email, phone, etc.) between you and the customer concerning the transaction, the customer’s IP address and download time and date (if the service is digital), and proof that the customer lives or works at the delivery address, among others.

3.2. Check the reason code

The next strategy to win a chargeback dispute as a seller is to check the reason code of the chargeback as soon as possible once it has been filed.

The reason code is an alphanumeric code, typically between 2 and 4 digits, that is provided by the issuing bank and identifies the reason for the dispute. In other words, it gives more information on why it happened.

It is important to know that each card network (MasterCard, VISA, Discover, AMEX, etc.) has developed its own reason code system, that’s why you need to check carefully the card that was used for the transaction.

A lot of times, the reason code will not actually provide accurate details on the true motive behind a chargeback, but the dispute will be based on it. Therefore, as a merchant, you need to be familiar with the reason code in order to argue effectively against it.

In order to win a chargeback dispute as a seller, make sure to check the reason code system of the corresponding card issuer, and study carefully the one that correlates with the disputed transaction.

Some reason codes include, but are not limited to:

• 57 - Fraudulent multiple transactions - the causes can be different, including that the merchant tried to process multiple transactions fraudulently. It can also mean that the cardholder authorized it earlier, but later denied it.

• 62 - Counterfeit transactions \- The cardholder denies authorizing or participating in the transaction

• 81 - Fraud – Card-Present Environment \- the cardholder didn’t authorize the transaction in a card-present environment

• 83 - Fraud – Card-Absent Environment - the cardholder didn’t authorize the transaction in a card-not-present environment

3.3. Resolve issues through customer service

Proactive customer service can go a long way towards resolving and preventing disputes from clients. So, if you want to win a chargeback dispute as a seller, it is one of the best tools you have to sort things out on time.

In many occasions, chargebacks are initiated by a frustrated user who was unable to easily recover funds from the company’s customer service department.

By providing clear contact information details and making refund policies available to customers, you can significantly reduce your chargeback volume.

Instead, clients will be more encouraged to resolve their issue directly with you instead of having to go to the credit card issuer.

Some companies are afraid to offer refunds because of losing revenue - but the reality of the situation is, you may end up losing a lot more revenue if you get a high chargeback rate as a result of costly penalties.

When a chargeback has been filed against you, you will usually have about 7 to 10 days to accept it or fight it through the card issuer’s channels.

During this period of time, you can contact the customer directly and work with him on resolving the problem efficiently. If satisfied, he will most probably undo the chargeback by contacting the corresponding card issuer.

If the customer’s problem is legitimate, it is always better to issue a refund instead of fighting the chargeback. However, if you still consider that his reasons were not valid, you might have to go to a dispute process.

4. React quickly

Once the dispute has been filed, you will have a very limited time to gather your evidence and prepare a winning response.

Take note of all applicable deadlines, format your documentation properly according to the requirements, study carefully the reason code, and prepare a chargeback rebuttal letter to accompany your evidence.

It might be helpful to prepare a response template with all the general information ahead of time, and just fill in with specific-case evidence when a chargeback happens. Some information that you may want to have in hand includes:

• Confirmation of delivery - any proof you have that the customer actually received the product or service they paid for;

• Proof of customer purchase - evidence that the purchase was made in the first place, or usage history

• Policies \- a copy of the refund or return policy that the customer agreed to;

• Matching data - AVS (address verification system) and CVV (card verification value) matches

• IP address - of the customer’s purchase device (if the transaction happened online), as well as the exact date and time of purchase, as well as the geographic location of the device.

• Correspondence \- any additional correspondence with the customer such as emails, phone records, and documented conversations.

5. Get help

Chargebacks can have a negative impact on businesses, especially merchants who are dealing with high chargeback ratios.

In order to optimize your resources, efforts and operations, getting help is a great way to win a chargeback dispute as a seller - or at least prevent them from happening that often.

You can get help with MYMOID - a powerful payment gateway for businesses that want to streamline all their payment operations at one place.

With MYMOID, you can enhance your payment experience with additional services including fraud prevention, card validation, and chargeback management.

Our secure Payment Gateway helps you reduce chargebacks and operations risk so you can focus on what really matters - your business.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

PCI-DSS for Merchants: Top 8 Key Steps to Becoming Compliant

What are some of the most important steps that need to be taken when it comes to PCI-DSS for merchants? Continue reading to learn more!

2022-09-25

Transacciones rechazadas: las 7 razones más comunes (2018)

Conoce cómo evitar un alto volumen de transacciones rechazadas.

2018-08-23

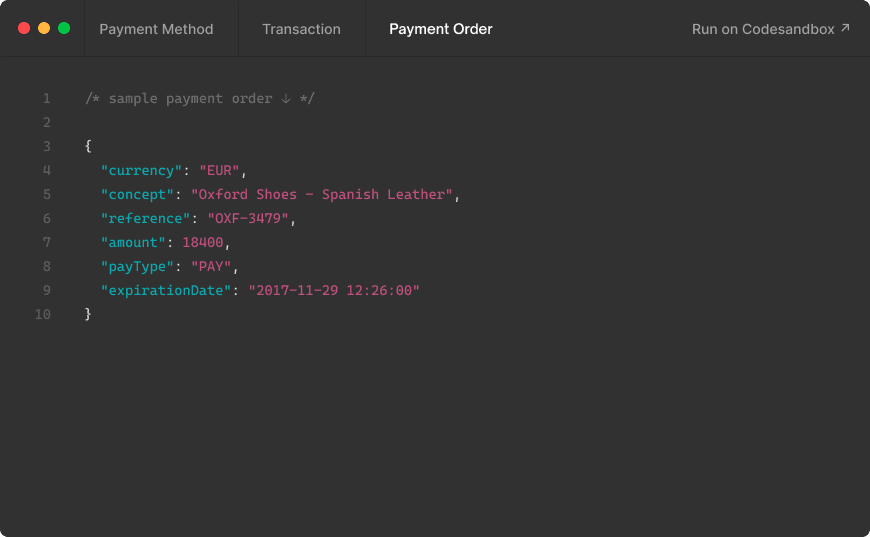

Acelera los pago lentos: generación masiva de ordenes de pago de MYMOID

¿Alguna vez has pensado en la cantidad de tiempo y esfuerzo que se desperdicia al crear y enviar órdenes de pago de forma manual? Automatizar tus procesos permite ahorro de tiempo y dinero.

2024-07-22

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy