How to Send a Payment Link in 3 Effective Steps

How can you send a payment link in 3 effective steps? Continue reading to learn more!

While ecommerce has enabled businesses of all sizes to become global and expand their target market, sending and receiving payments overseas is still a central issue.

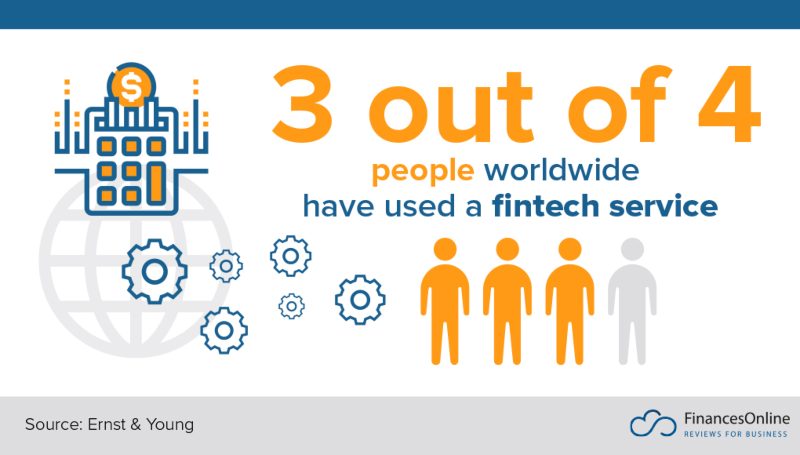

In the past few years, FinTech companies emerged in order to deal with international payments, cut costs, and provide better services than traditional banks. And while the traditional banking scene is changing to incorporate this growing demand as well, they still can't keep up with FinTech companies who are bringing a series of innovations to the market.

One of the best solutions for sending or receiving payments from anyone at any place is via the pay-by-link method. In this method, you can generate a payment link for a particular customer and send it to that entity.

The customer will be able to pay the due amount in a few simple steps. You can use this method to both send and receive payments.

If you want to know more about this hassle-free end-to-end payment method, keep reading to find out what it is and how you can send a payment link in a few effective steps.

What is a payment link?

A payment link, also known as payment request link, is a streamlined and efficient way to transfer payments online. Once you generate a payment link, you can send it to the customer through any channel you want, such as SMS, email, social media DMs, or even attach the link to your business bio or profile on social media.

Anyone can click that link to make payments. This is a good way to receive payments as a business owner because it's fast, convenient, and highly effective.

You can send a payment link in a number of transactional situations. The link can be generated for only one specific customer, or it can be a general link that can be added to a public profile so that anyone can access it.

You can also time the links, such as one-time links for a single transaction or a permanent link that would work for ongoing transactions. You can set more specific time limits as well.

You can send a payment link as a URL or a QR code. QR codes can be displayed on ads, brochures, printouts, and landing pages.

How to send a payment link?

To send a payment to link to anyone, you must first decide on the payment gateway that you are going to use in order to create the link. The exact steps you take will depend on your payment provider, but you will have to go through the same process most of the time.

So, here is an overview of how you can send a payment link in three effective steps.

1. Set up your payment gateway of choice

The first step that you will need to take in order to send a payment link is to set up the payment gateway of your choice. Selecting the right payment gateway can be challenging if you don't have any experience within the industry, but here are some factors that you will need to consider in order to make the right choice for your business:

• Pay attention to security - security is extremely important when it comes to online payments, so make sure that you are selecting a PCI-compliant payment gateway that meets all the practices outlined by the biggest credit card issuers in the PCI-DSS standard.

• Features - a good payment gateway will not only allow you to send a payment link, but will allow you to accept online payments in multiple other ways. Plus, gateways such as MYMOID offer advanced features to further enhance the payment experience for your customers and reduce the number of chargebacks.

• International scope - if you are planning to grow your business in the future, going for a gateway that allows you to expand internationally will be a must. Otherwise, you may need to hire another gateway for each country that you are planning to expand to, so it's not going to be very effective in terms of costs and resources. MYMOID gives you the possibility to accept payments in 45 countries and 128 currencies.

• Personalization - being able to personalize the payment experience for your customers is essential if you are looking to increase your conversion rate and decrease the number of declined transactions.

Once you've selected the right payment gateway for your business, the next step will be to set it up, and you will be ready to send a payment link to your customers.

2. Generate a payment link

In this next step, you must create a payment link that will be sent to the end customer. This is where you will have to put in the billing conditions and other terms. You will also add the person or business that can access the link for payments.

The exact steps on how to do that will depend on the payment gateway that you've selected, but overall, generating the payment link is pretty quick and straightforward, and you will only need a few minutes to do it.

3. Send a payment link

The payment link you just generated via your PSP is secure and reliable. You can send that link to the customer in the inbox, SMS, or other channels of choice. The customer can open the link and make the payment with just one swift click.

How to send a payment link through SMS

There are no special requirements to send a payment link through SMS. You can copy the link you generated on your payment service provider's page and paste it into the blank SMS space. Send the message, and the customer can use that link at any time to make the payment.

It is very easy to send a payment link through SMS. There is no need for extensive training, which saves time and money. This reliable and secure method does not require the customer to log in to or visit any websites to make payments, eliminating delays and bad debts.

Sending the payments through SMS is also safe as the sender does not have to put in passwords or other confidential details.

How to Send a Payment Link via QR Code

You can also send a payment link through QR codes. A QR code is printed on the payment letter or invoice sent to the customer. The customer must scan this QR code on a cell phone, redirecting them to the payment page. Here the sender can add the products they intend to buy and pay for them immediately.

The QR can be attached or displayed on a public profile of the business and in other places. This method is fast, secure, and reliable as well. There is no need for account details or passwords, so it's completely secure too.

Is it safe to use payment links for transfers?

In most cases, it is safe to send a payment link and make a transfer with it. Usually, payment gateways use encryption, tokenization and other methods to secure payments and transactions.

Moreover, the customers can use MasterCard and Visa Credit Card to make payments which ensures that there is strong protection for all customer transactions and card information.

There are a few points to consider to ensure the maximum security of payment links. An SSL protocol should be present, adding a layer of security.

The PSP must be compliant with PCI DSS. Check to see at what security level the PSP stands. PCI DSS is the global standard of safety in terms of a data breach. It lays out the guidelines to let the providers know what needs to be done in case of an information leak.

Other factors that influence the safety of payment links include brand repute – a trusted brand will have fewer chances of a security breach. Most message platforms are encrypted but make sure to share links through safe channels only.

As a customer, you should also do your own research. Make sure you stick with a trusted business that you know would use a reliable payment service provider. This is because the safety of your payments depends on the PSP, as they are the third-party processors here.

If you have to use payment links to receive payments, make sure to stick to the payment service providers and payment gateways that are known to be trustworthy.

How to choose a payment gateway for your payment link

There are several payment gateways that you can choose from to send payment links. However, not all gateways are made equal, and you must do your due diligence to ensure you choose a service provider you can trust with your transactions.

There are other considerations for choosing a provider, such as the processing fee, the other payment options included, the process of sending the link, and more.

There are several big names in the payment service providers list. Not all are made equal, and not every service provider will be able to give you exactly what you need. So, you need to ensure that you choose the payment service provider that fits your requirement outline.

Whether you are just starting out or already using this method of payment, you need to keep the following points in mind before choosing a payment gateway.

The payment gateway should be well accepted in the international community. Ding business across borders is difficult if your customers from other countries don’t trust your provider. So, choose a well-reputed one. The gateway should be able to adapt to different devices such as PCs and mobiles.

The ability to integrate, such as API integration with your existing software and applications, is essential. For example, with MYMOID, you can integrate quickly and easily with our powerful API-rest. The gateway must comply with global standards of security, such as the Payment Card Industry Data Security Standard or PCI DSS.

Ensure the gateway provides the required services like subscription offers, customer support, etc. Moreover, pricing packages that are affordable should be a top priority too.

Conclusion

Payment links have been gaining traction for being a secure and reliable method of transferring payments. This method can be incorporated into the website individually or as an alternative to other payment gateways.

All you have to do is make an account with the payment gateway of your choice, set up your payment page, and create a payment link by adding all the billing details. Then, you can send this payment link to anyone customer anywhere in the world.

The end-to-end encryption that most payment service providers have ensures that you can send a payment link without worrying about the safety of your information.

There is no lengthy process of logging in or putting in details involved in transfers through payment links. The payments can be sent at any time, eliminating the need to run after due bills.

You can certainly incorporate payment links as one of the secure payment gateways on your eCommerce site. Are you ready to get started? Contact us today!

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

¿Qué es una pasarela de pagos y cómo funciona?

¿Qué es exactamente la pasarela de pagos y cómo funciona? En este artículo, te explicamos la ciencia detrás de este servicio digital

2017-11-07

What Are Friendly Fraud Chargebacks? +9 Top Ways to Fight Them

let's take a look at what a chargeback exactly is

2022-07-02

6 Types of Payment Methods & Their Pros and Cons

Know about the different types of payment methods that customers can choose from in 2022, and why merchants should aim to offer as many as possible.

2022-07-02

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy