3 Common Types of Chargebacks & How to Deal With Them

What are the most common types of chargebacks, and what can merchants do in order to handle them safely? Continue reading to learn more!

Chargebacks, also known as payment disputes, are among the biggest issues that merchants have to deal with when it comes to credit card transactions. Initially intended as an extra layer of security and protection for customers, they have grown into an issue that can cause costly penalties for merchants that don't handle them properly.

Depending on the credit card network, exceeding a certain chargeback rate may result in penalties running as high as $1,000 per day. For this reason, it's extremely important that merchants are aware of the different types of chargebacks that exist, and know the best practices to prevent them or deal with them if they happen.

But before we take a look into the different types of chargebacks, let's answer some key questions:

What is a chargeback?

A chargeback, or a payment dispute, is a reversal of funds from the merchant to the customer forced by the issuing bank of the customer. As opposed to a refund, which is issued by the merchant in exchange for the return of the purchase, chargebacks occur when the customer is disputing the validity of the transaction directly with the bank.

As we just mentioned, high chargeback rates can seriously hurt businesses, causing them to incur in costly fees, or directly endangering their reputation with payment processors. For most industries, the average chargeback-to-transaction ratio is 0.60%, or 6 out of 1000 transactions.

However, card issuers such as VISA and Mastercard will apply penalties for merchants that have chargeback rates of over 1%, which is considered too high.

Image source. Types of chargebacks and their impact.

How does a chargeback work?

When a customer decides to file a chargeback, the disputed funds of the transaction will be held from the merchant until the credit card issuer evaluates the situation and decides how to proceed. If the bank rules against the merchant, the funds will be returned to the customer. However, the bank may also rule in the favor of the merchant, in which case the funds will be send back to them.

It's important to know that chargebacks can be both legitimate and fraudulent. For example, if a customer isn't happy with their purchase, but the merchant refuses to process a refund, the customer may decide to file a chargeback instead.

Some common reasons include why a customer may file a chargeback include:

• The don't recognize the charge on their card

• They had already cancelled their subscription, but were still charged

• The product they ordered doesn't match the description

• They never received the product or service

• The information has been stolen, and is being used in a fraudulent manner

• A refund wasn't possible or easily available

Some chargebacks happen as a result from bad practices on the merchants' side (such as having an unclear return policy), and others may be associated with suspicious or fraudulent activity.

Is a chargeback the same as a refund?

While the end outcome may be the same, a chargeback isn't the same as a refund. Both actions are initiated by the cardholder, but the main difference is that refunds are issued by the merchant, while chargebacks are disputed by the customer directly with the issuing bank.

Both actions mean that the merchant will lose money from the transaction. However, chargebacks can have a significantly stronger negative impact as they are usually associated with higher fees, and may cause penalties by the issuers if the rate is too high.

Fortunately, there are some good practices to reduce chargebacks fast and prevent them to the highest extend possible in the future. One of them is to work with a Payment Gateway that allows merchants to have full control over their payment logic, and is fully compliant with PCI-DSS (The Payment Card Industry Data Security Standard).

Types of chargebacks

Now that we have cleared out some important concepts around chargebacks, let's take a look at the different types of chargebacks that exist, and what each of them means for your business:

1. Criminal fraud chargeback

Criminal fraud chargebacks occur when criminals steal a credit card or a credit card number, and start making unauthorized purchases with it. Unfortunately, a lot of time may pass until this type of fraud comes to light, and it usually happens when the actual cardholder reviews the transaction statement and identifies it as illegitimate.

According to Chargebacks911, total losses from criminal fraud chargeback amounted to the mind-blowing 9.8 billion in the US in 2018, causing huge revenue loss for businesses of all sizes. In fact, studies conducted by Shuftipro found out that between 1% and 10% of all frauds occur as a result from chargeback scams.

Criminal fraud chargeback is something that all businesses should be well aware of. Luckily, a lot of chargeback scams can be prevented by monitoring and identifying red flags in consumers' behavior. Some red flags that merchants should watch out for include:

1.1. Orders that are larger than expected.

As a rule of thumb, merchants should always be suspicious of really large orders that exceed their average transaction amount. Fraudsters typically have a limited time to use the stolen credit card before the theft is found out, so they try to take advantage of it as quickly as possible.

1.2. Difference in addresses

When monitoring different types of chargebacks, and especially criminal chargeback fraud, another red flag that merchants should be looking for are addresses. Fraudsters often use a different address for "ship to" and "bill to".

In other occasions, criminals may be using the same account but different addresses, sharing the stolen credit card number with friends.

1.3. Multiple cards for one order

Another suspicious activity that businesses should be monitoring carefully are purchases in which potential criminals are using multiple cards for one large order. This could be indicating that the fraudster is testing the stolen cards to see which one will work.

1.4. International shipping

While most purchases involving international shipping are completely legitimate, it isn't uncommon that some of them may turn out to be a scam. Criminals know that it's almost impossible to get caught or prosecuted from a different country, so it's always good to double-check international orders for other possible red flags.

Especially if they are coming from countries that are commonly associated with fraud.

1.5. Repetitive orders

Repetitive orders can also be an indication of criminal fraud chargeback. As a merchant, if you receive an order that has a big quantity of the same item but in different sizes or colors, make sure to proceed with caution, especially if you notice other suspicious activity on the transaction.

2. Friendly fraud chargeback

Second on our list of types of chargebacks is Friendly fraud.

Friendly fraud, which is anything but friendly, occurs when a legitimate customer purchases a product or a service, receives it from the merchant, but files a chargeback anyway. In other words, it is committed with the knowledge of the transaction, even though it was reported as unauthorized.

According to Chargebacks911, friendly fraud chargebacks will represent more than 61% of all chargebacks issued in the US by 2023, and roughly 40% of consumers who commit them will do it again in the next 60 days.

Some customers may commit friendly fraud unintentionally because they aren't aware of how the process works, or because they didn't know the consequences of their actions and how they would impact the merchant.

However, other customers will do it on purpose, taking advantage of a practice known as "cyber-shoplifting" - a type of theft involving dishonest chargebacks & piracy targeting online businesses. In this case, they received the product or service without any issues, but they filed for a feedback anyway.

Unfortunately, friendly fraud can be difficult to prevent, but the actions that you can take as a merchant will depend on the types of chargebacks:

2.1. Accidental friendly fraud

If the type of friendly fraud was unintentional and was caused out of confusions, there are a few things that businesses can do in order to prevent it in the future. On one hand, they can ensure that they have a merchant descriptor that matches the name of the business that the customer knows (as opposed to the legal, less-known name).

An accidental friendly fraud may also happen out of convenience because the company didn't have the best refund practices put in place, so the customer decided to file a chargeback instead. For this reason, it's important that businesses have a clear refund policy, and make refunds easy and accessible to process.

Some merchants are afraid of offering refunds (or they hide them), but the reality is, a chargeback is much worse than a refund. And if customers aren't able to get their refund, they may start filing chargebacks, resulting in penalties for businesses by the credit card issuers.

Additionally, companies should have their contact information easily accessible at all times to help customers and address their worries and questions. A lot of possible chargebacks can be avoided if the consumer could easily get in touch with the merchant.

2.2. Intentional friendly fraud

Next on our list of types of chargebacks is intentional friendly fraud.

As we previously mentioned, intentional friendly fraud means exactly what you would expect - it didn't happen by accident. In other words, the legitimate customers made a purchase for a product or a service, received it without any issues or mismatch in expectations, but decided to file for a chargeback to get their money back while keeping the product.

The customer may claim that they didn't receive the product, it didn't match their expectations, or the merchant didn't want to give them a refund (even though it wasn't the case).

Intentional friendly fraud chargebacks can be challenging to prevent and fight, especially because it can be difficult to determine whether the chargeback was intentional or not. However, merchants can try fighting them by thoroughly documenting each order, and providing relevant documentation to the issuing bank to prove their case.

It can be especially challenging of the company has a lax refund, a policy that doesn't limit the number of times a customer can return or ask for a refund, or allows them to return products without reason.

Some ways to battle intentional friendly fraud include:

3. Merchant error chargeback

Third on our list of types of chargebacks is the merchant error chargeback.

It typically occurs when the customer doesn't get the product or service that they paid for (it didn't meet their expectations), or if the merchant mistakenly charges the cardholder with a duplicate, incorrect, or unauthorized transaction.

A common occurrence are customers still being charged despite a cancelled subscription for SaaS products, for example. Other causes for merchant errors include:

• Incorrect billing descriptions

• Errors when processing transactions

• Imprecise product descriptions

• Unclear return policies

According to Chargebacks911, merchants errors amount for 20-40% of all chargebacks. For this reason, it is important that they put the best practices into place to ensure that they are providing the most clear information possible to the customer.

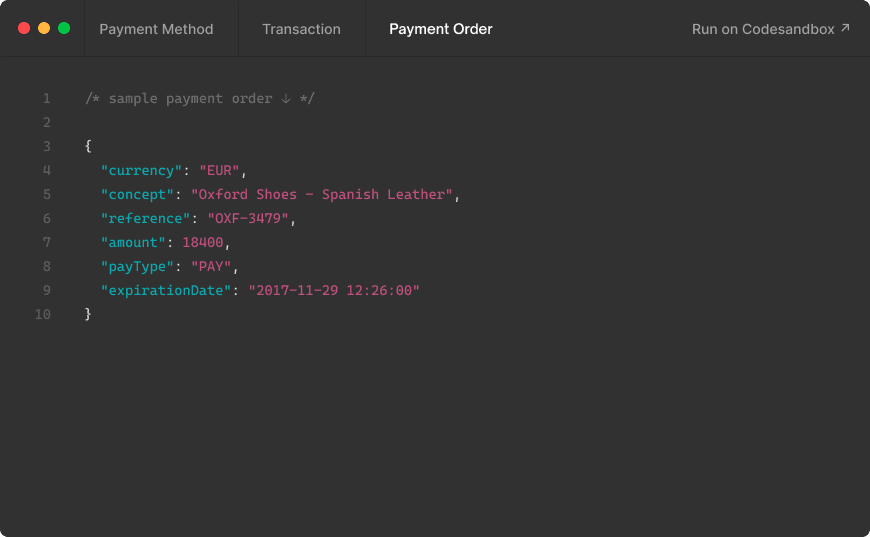

Payment gateways such as MYMOID can help you handle chargebacks as a result from a merchant error through chargeback prevention tools, analytics tools, and features such as credit card pre-authorizations. In many occasions, resolving the complaints of the customers before they demand a chargeback is the best way to reduce your chargeback rates.

Types of chargebacks: conclusion

Considering the different types of chargebacks that merchants are constantly facing, it is safe to say that they can be a huge challenge for the health of any business. As we mentioned at the beginning, high chargeback rates not only result in additional costs for the merchant, but may also lead to penalties from card issuers.

For this reason, it's crucial to implement a safe Payment Gateway such as MYMOID to ensure that you are using all the possible tools and best practices for the prevention of chargebacks. It is also important to constantly monitor suspicious activity, and analyze the root of the chargeback to address the issues accordingly.

Additionally, you can take a look at our article Winning a Chargeback Dispute: 4 tips to increase your chances (as a merchant) for more information on the types of chargebacks, and how to win a chargeback dispute.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Acquiring bank: definition and role in payment processing

What exactly is an acquiring bank, and what are its main functions in the process of managing transactions?

2021-01-10

¿Qué es una pasarela de pagos y cómo funciona?

¿Qué es exactamente la pasarela de pagos y cómo funciona? En este artículo, te explicamos la ciencia detrás de este servicio digital

2017-11-07

4 consejos para ganar una disputa por chargeback (como comercio)

Conoce las medidas que puedes tomar para aumentar tus posibilidades de ganar una disputa por chargeback.

2018-08-16

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy